Question: PLEASE, DO NOT COPY ANOTHER ANSWER. THESE QUESTIONS ARE DIFFERENT AND THE ANSWERS WILL BE WRONG. PLEASE SHOW WORK AND ACTUALLY HELP ME. THANK YOU.

PLEASE, DO NOT COPY ANOTHER ANSWER. THESE QUESTIONS ARE DIFFERENT AND THE ANSWERS WILL BE WRONG. PLEASE SHOW WORK AND ACTUALLY HELP ME. THANK YOU. ALSO ANSWER ALL OF THE PARTS. THANK YOU.

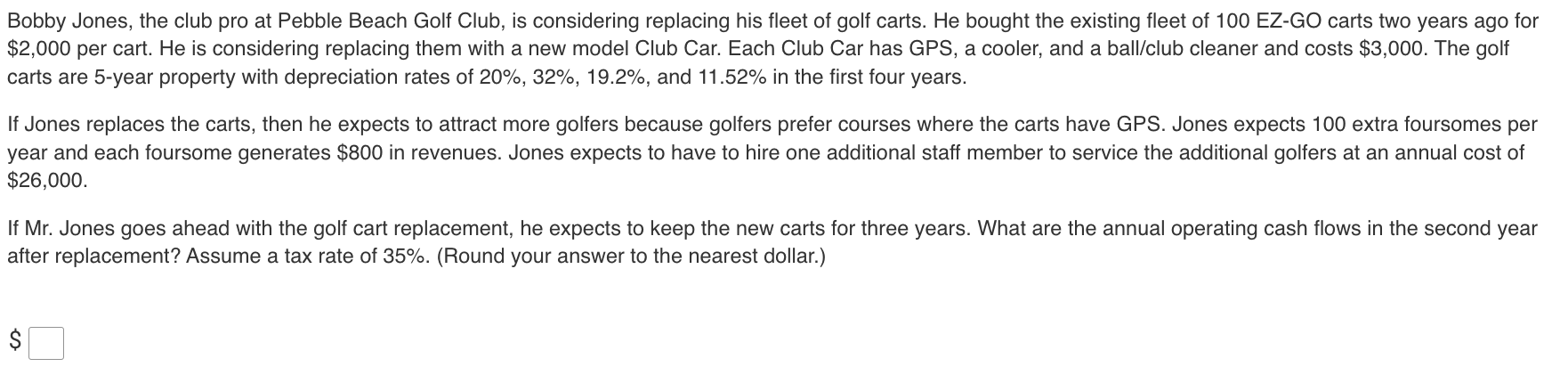

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts