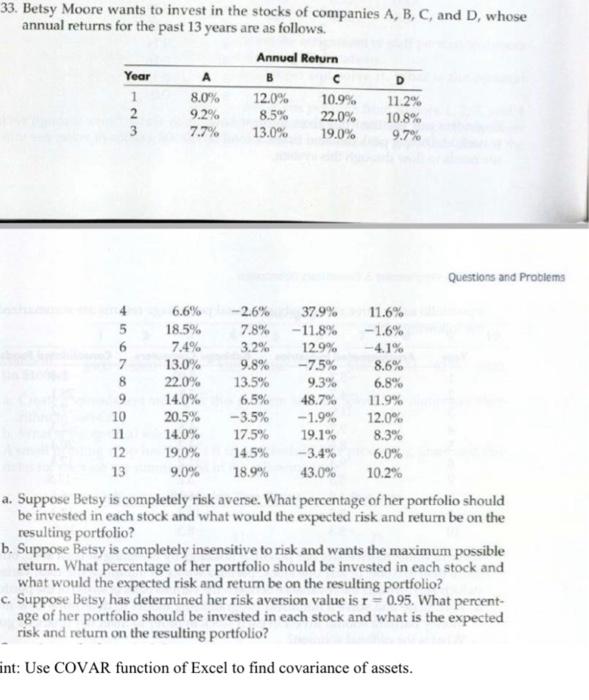

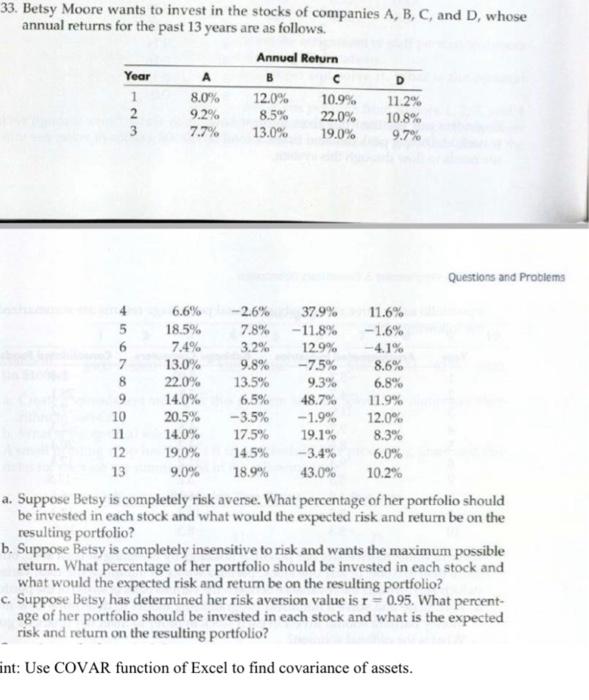

Question: PLEASE DO NOT COPY PASTE ANSWER FROM SIMILAR CHEEG QUESTIONS. Thank you 33. Betsy Moore wants to invest in the stocks of companies A, B,

PLEASE DO NOT COPY PASTE ANSWER FROM SIMILAR CHEEG QUESTIONS. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock