Question: PLEASE DO NOT COPY SOMEONE ELSE ANSWER, THEYRE ALL WRONG, SHOW WORK AND ILL RATE CORRECT ANSWERS ONLY !! thanks Universal bank launched a campaign

PLEASE DO NOT COPY SOMEONE ELSE ANSWER, THEYRE ALL WRONG, SHOW WORK AND ILL RATE CORRECT ANSWERS ONLY !! thanks

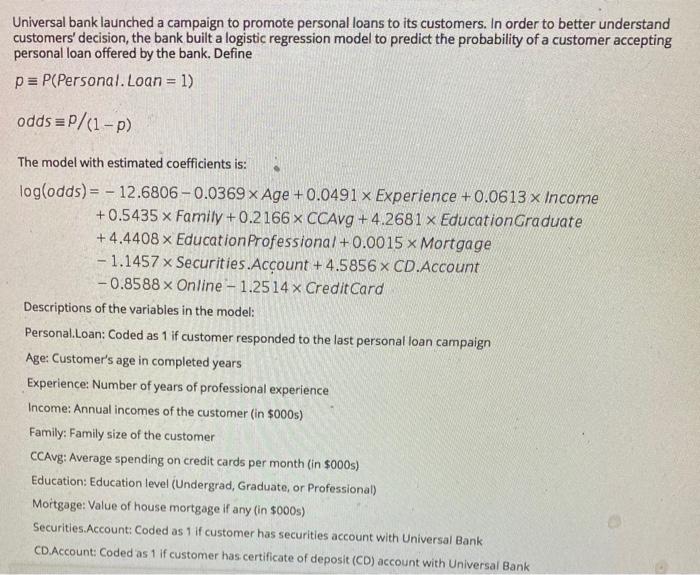

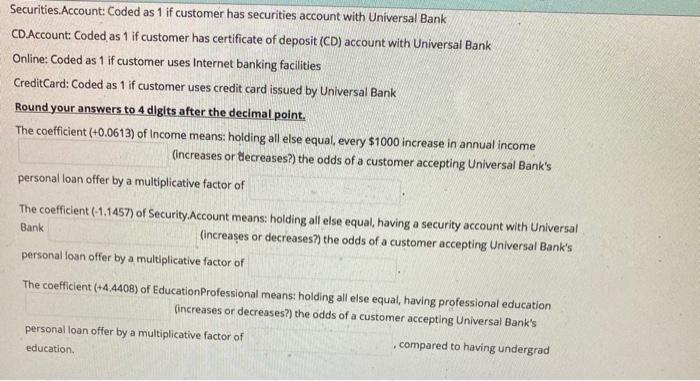

Universal bank launched a campaign to promote personal loans to its customers. In order to better understand customers' decision, the bank built a logistic regression model to predict the probability of a customer accepting personal loan offered by the bank. Define P= P(Personal. Loan = 1) odds = p/(1-P) The model with estimated coefficients is: log(odds) = - 12.6806 -0.0369 x Age +0.0491 x Experience +0.0613 x Income +0.5435 x Family +0.2166 x CCAvg +4.2681 x Education Graduate +4.4408 x Education Professional +0.0015 x Mortgage - 1.1457 x Securities.Account +4.5856 x CD.Account -0.8588 x Online - 1.2514 x Credit Card Descriptions of the variables in the model: Personal Loan: Coded as 1 if customer responded to the last personal loan campaign Age: Customer's age in completed years Experience: Number of years of professional experience Income: Annual incomes of the customer (in $000s) Family: Family size of the customer CCAvg: Average spending on credit cards per month (in $000s) Education: Education level (Undergrad, Graduate, or Professional) Mortgage: Value of house mortgage if any in $000s) Securities.Account Coded as 1 if customer has securities account with Universal Bank CD Account Coded as 1 if customer has certificate of deposit (CD) account with Universal Bank Securities.Account: Coded as 1 if customer has securities account with Universal Bank CD.Account: Coded as 1 if customer has certificate of deposit (CD) account with Universal Bank Online: Coded as 1 if customer uses Internet banking facilities Credit Card: Coded as 1 if customer uses credit card issued by Universal Bank Round your answers to 4 digits after the decimal point. The coefficient (+0.0613) of Income means: holding all else equal, every $1000 increase in annual income (increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of The coefficient (-1.1457) of Security. Account means: holding all else equal, having a security account with Universal Bank (increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of The coefficient (+44408) of Education Professional means: holding all else equal, having professional education increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of compared to having undergrad education. Universal bank launched a campaign to promote personal loans to its customers. In order to better understand customers' decision, the bank built a logistic regression model to predict the probability of a customer accepting personal loan offered by the bank. Define P= P(Personal. Loan = 1) odds = p/(1-P) The model with estimated coefficients is: log(odds) = - 12.6806 -0.0369 x Age +0.0491 x Experience +0.0613 x Income +0.5435 x Family +0.2166 x CCAvg +4.2681 x Education Graduate +4.4408 x Education Professional +0.0015 x Mortgage - 1.1457 x Securities.Account +4.5856 x CD.Account -0.8588 x Online - 1.2514 x Credit Card Descriptions of the variables in the model: Personal Loan: Coded as 1 if customer responded to the last personal loan campaign Age: Customer's age in completed years Experience: Number of years of professional experience Income: Annual incomes of the customer (in $000s) Family: Family size of the customer CCAvg: Average spending on credit cards per month (in $000s) Education: Education level (Undergrad, Graduate, or Professional) Mortgage: Value of house mortgage if any in $000s) Securities.Account Coded as 1 if customer has securities account with Universal Bank CD Account Coded as 1 if customer has certificate of deposit (CD) account with Universal Bank Securities.Account: Coded as 1 if customer has securities account with Universal Bank CD.Account: Coded as 1 if customer has certificate of deposit (CD) account with Universal Bank Online: Coded as 1 if customer uses Internet banking facilities Credit Card: Coded as 1 if customer uses credit card issued by Universal Bank Round your answers to 4 digits after the decimal point. The coefficient (+0.0613) of Income means: holding all else equal, every $1000 increase in annual income (increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of The coefficient (-1.1457) of Security. Account means: holding all else equal, having a security account with Universal Bank (increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of The coefficient (+44408) of Education Professional means: holding all else equal, having professional education increases or decreases?) the odds of a customer accepting Universal Bank's personal loan offer by a multiplicative factor of compared to having undergrad education

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock