Question: Please do not cut and paste another post. d. Which of these projects should you ideally choose? 8. The net present value rule versus the

Please do not cut and paste another post.

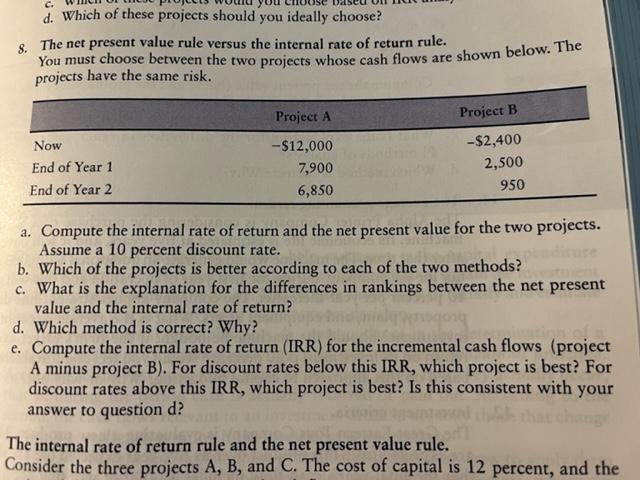

d. Which of these projects should you ideally choose? 8. The net present value rule versus the internal rate of return rule. You must choose between the two projects whose cash flows are shown below. The projects have the same risk. a. Compute the internal rate of return and the net present value for the two projects. Assume a 10 percent discount rate. b. Which of the projects is better according to each of the two methods? c. What is the explanation for the differences in rankings between the net present value and the internal rate of return? d. Which method is correct? Why? e. Compute the internal rate of return (IRR) for the incremental cash flows (project A minus project B). For discount rates below this IRR, which project is best? For discount rates above this IRR, which project is best? Is this consistent with your answer to question d ? The internal rate of return rule and the net present value rule. Consider the three proiects A,B, and C. The cost of capital is 12 percent. and the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts