Question: Please do not hard code values Jiminy's Cricket Farm issued a 30-year, 7 percent semiannual bond 3 years ago. The bond currently sells for 93

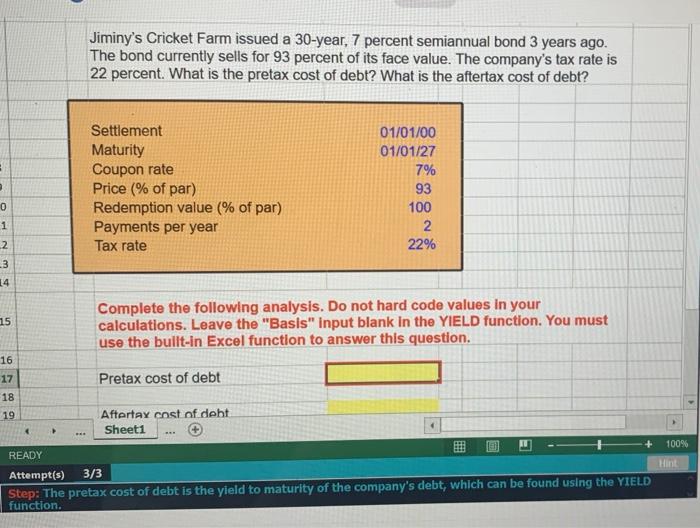

Jiminy's Cricket Farm issued a 30-year, 7 percent semiannual bond 3 years ago. The bond currently sells for 93 percent of its face value. The company's tax rate is 22 percent. What is the pretax cost of debt? What is the aftertax cost of debt? Settlement 01/01/00 Maturity 01/01/27 Coupon rate 7% Price (% of par) 93 Redemption value (% of par) 100 Payments per year 2 Tax rate 22% Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the YIELD function. You must use the built-in Excel function to answer this question. Pretax cost of debt Aftertax cost of debt. Sheet1 *** READY Hint Attempt(s) 3/3 Step: The pretax cost of debt is the yield to maturity of the company's debt, which can be found using the YIELD function. { 1 0 1 2 3 14 15 16. 17 18 19 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts