Question: Please do not just write the final results, instead give the mathematical calculations. Question 1. You have been given the following information about a company.

Please do not just write the final results, instead give the mathematical calculations.

Please do not just write the final results, instead give the mathematical calculations.

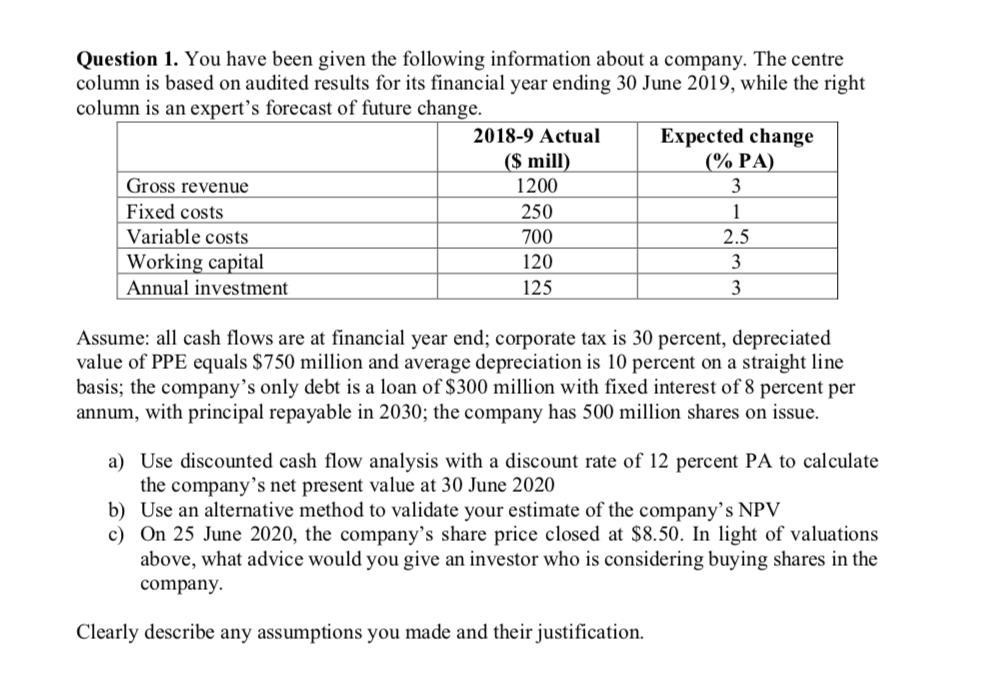

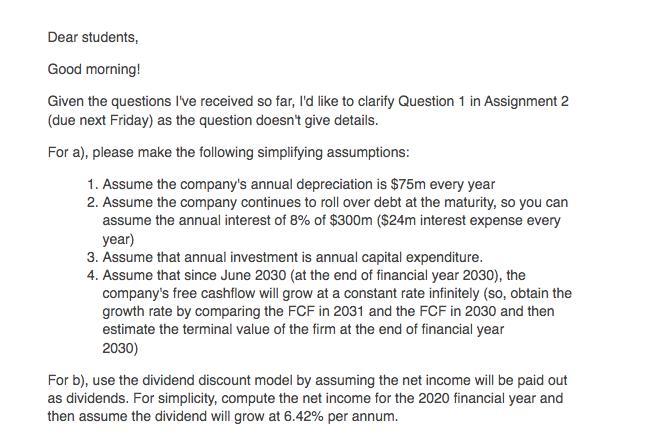

Question 1. You have been given the following information about a company. The centre column is based on audited results for its financial year ending 30 June 2019, while the right column is an expert's forecast of future change. Assume: all cash flows are at financial year end; corporate tax is 30 percent, depreciated value of PPE equals $750 million and average depreciation is 10 percent on a straight line basis; the company's only debt is a loan of $300 million with fixed interest of 8 percent per annum, with principal repayable in 2030; the company has 500 million shares on issue. a) Use discounted cash flow analysis with a discount rate of 12 percent PA to calculate the company's net present value at 30 June 2020 b) Use an alternative method to validate your estimate of the company's NPV c) On 25 June 2020 , the company's share price closed at $8.50. In light of valuations above, what advice would you give an investor who is considering buying shares in the company. Clearly describe any assumptions you made and their justification. Dear students, Good morning! Given the questions I've received so far, I'd like to clarify Question 1 in Assignment 2 (due next Friday) as the question doesn't give details. For a), please make the following simplifying assumptions: 1. Assume the company's annual depreciation is $75m every year 2. Assume the company continues to roll over debt at the maturity, so you can assume the annual interest of 8% of $300m (\$24m interest expense every year) 3. Assume that annual investment is annual capital expenditure. 4. Assume that since June 2030 (at the end of financial year 2030), the company's free cashflow will grow at a constant rate infinitely (so, obtain the growth rate by comparing the FCF in 2031 and the FCF in 2030 and then estimate the terminal value of the firm at the end of financial year 2030) For b), use the dividend discount model by assuming the net income will be paid out as dividends. For simplicity, compute the net income for the 2020 financial year and then assume the dividend will grow at 6.42% per annum. Question 1. You have been given the following information about a company. The centre column is based on audited results for its financial year ending 30 June 2019, while the right column is an expert's forecast of future change. Assume: all cash flows are at financial year end; corporate tax is 30 percent, depreciated value of PPE equals $750 million and average depreciation is 10 percent on a straight line basis; the company's only debt is a loan of $300 million with fixed interest of 8 percent per annum, with principal repayable in 2030; the company has 500 million shares on issue. a) Use discounted cash flow analysis with a discount rate of 12 percent PA to calculate the company's net present value at 30 June 2020 b) Use an alternative method to validate your estimate of the company's NPV c) On 25 June 2020 , the company's share price closed at $8.50. In light of valuations above, what advice would you give an investor who is considering buying shares in the company. Clearly describe any assumptions you made and their justification. Dear students, Good morning! Given the questions I've received so far, I'd like to clarify Question 1 in Assignment 2 (due next Friday) as the question doesn't give details. For a), please make the following simplifying assumptions: 1. Assume the company's annual depreciation is $75m every year 2. Assume the company continues to roll over debt at the maturity, so you can assume the annual interest of 8% of $300m (\$24m interest expense every year) 3. Assume that annual investment is annual capital expenditure. 4. Assume that since June 2030 (at the end of financial year 2030), the company's free cashflow will grow at a constant rate infinitely (so, obtain the growth rate by comparing the FCF in 2031 and the FCF in 2030 and then estimate the terminal value of the firm at the end of financial year 2030) For b), use the dividend discount model by assuming the net income will be paid out as dividends. For simplicity, compute the net income for the 2020 financial year and then assume the dividend will grow at 6.42% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts