Question: Please, do not leave anything unanswered; please only answer if you are sure about the answers. Thank you! Exercise 6-12 Variable Costing Income Statement. Reconciliation

Please, do not leave anything unanswered; please only answer if you are sure about the answers. Thank you!

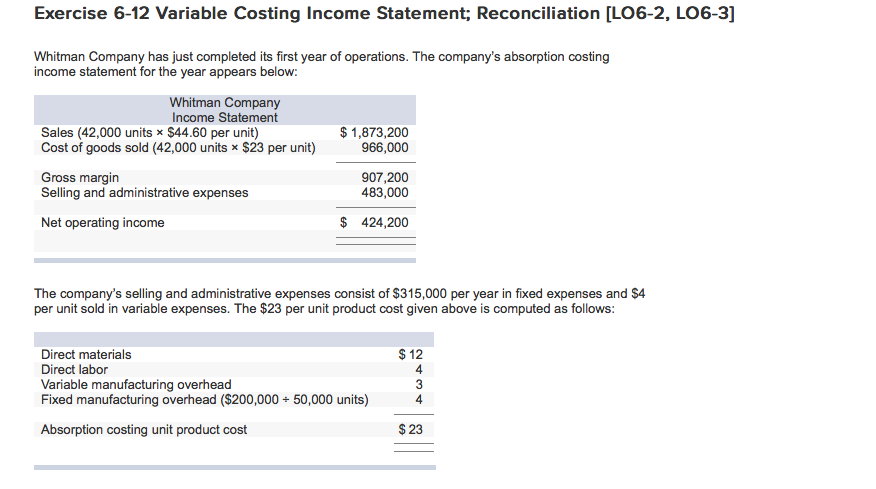

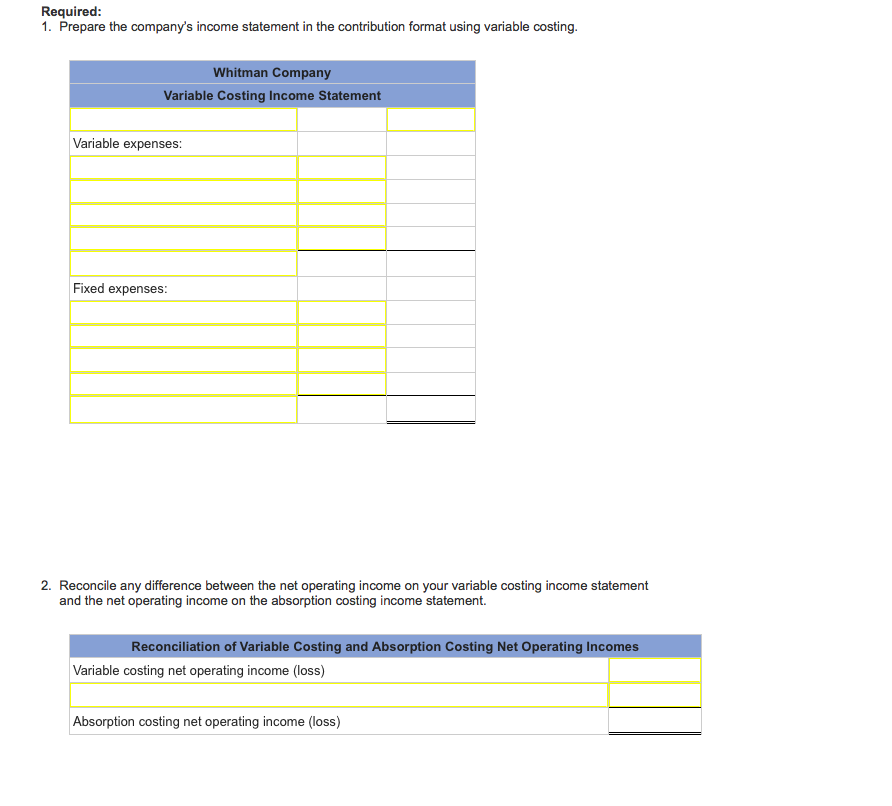

Exercise 6-12 Variable Costing Income Statement. Reconciliation [LO6-2, LO6-3U Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year appears below Whitman Company Income Statement 1,873,200 Sales (42,000 units x $44.60 per unit) Cost of goods sold (42,000 units x $23 per unit) 966,000 907,200 Gross margin Selling and administrative expe 483,000 424,200 Net operating income The company's selling and administrative expenses consist of $315,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $23 per unit product cost given above is computed as follows 12 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($200,000 50,000 units) 4 $23 Absorption costing unit product cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts