Question: Please do not provide answer on excel. Please explain the answer step by step please Thank you Q#2: Jupiter Inc.'s directors are considering expanding their

Please do not provide answer on excel. Please explain the answer step by step please Thank you

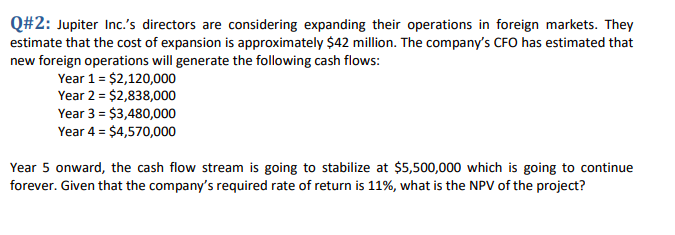

Q#2: Jupiter Inc.'s directors are considering expanding their operations in foreign markets. They estimate that the cost of expansion is approximately $42 million. The company's CFO has estimated that new foreign operations will generate the following cash flows: Year 1 = $2,120,000 Year 2 = $2,838,000 Year 3 = $3,480,000 Year 4 = $4,570,000 Year 5 onward, the cash flow stream is going to stabilize at $5,500,000 which is going to continue forever. Given that the company's required rate of return is 11%, what is the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts