Question: please do not recopy any answer on chegg to this question i've viewed them all and they're all wrong or ill give a thumbsdown if

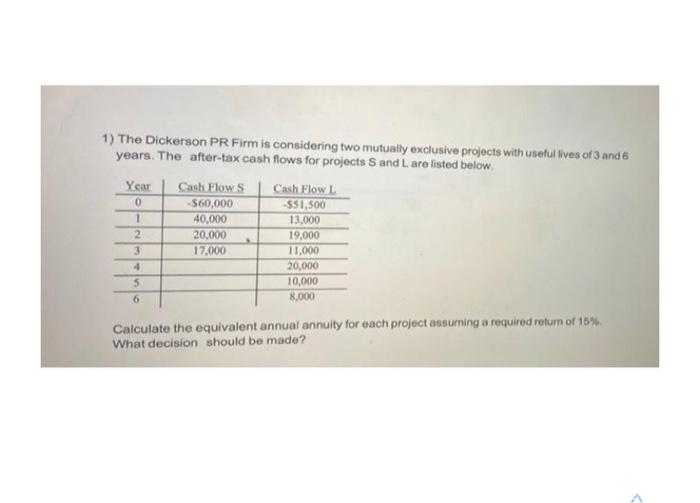

1) The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years. The after-tax cash flows for projects S and L are listed below. Year Cash Flows Cash Flow L 0 -S60,000 $51.500 1 40.000 13,000 2 20,000 19.000 3 17.000 11,000 4 20,000 5 10,000 6 8.000 Calculate the equivalent annual annuity for each project assuming a required retum of 15% What decision should be made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts