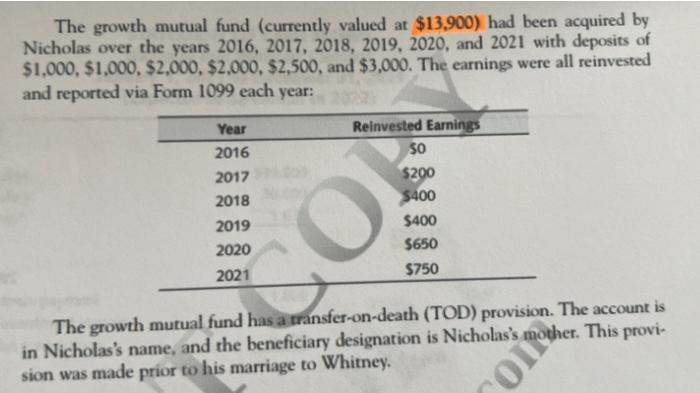

Question: please do not round answer The growth mutual fund (currently valued at $13,900 ) had been acquired by Nicholas over the years 2016,2017,2018,2019,2020, and 2021

The growth mutual fund (currently valued at $13,900 ) had been acquired by Nicholas over the years 2016,2017,2018,2019,2020, and 2021 with deposits of $1,000,$1,000,$2,000,$2,000,$2,500, and $3,000. The earnings were all reinvested and reported via Form 1099 each year: The growth mutual fund has a transfer-on-death (TOD) provision. The account is in Nicholas's name, and the beneficiary designation is Nicholas's mother. This provision was made prior to his marriage to Whitney. If the Clements sell the growth mutual fund for $14,238, what will be the reported gain? The growth mutual fund (currently valued at $13,900 ) had been acquired by Nicholas over the years 2016,2017,2018,2019,2020, and 2021 with deposits of $1,000,$1,000,$2,000,$2,000,$2,500, and $3,000. The earnings were all reinvested and reported via Form 1099 each year: The growth mutual fund has a transfer-on-death (TOD) provision. The account is in Nicholas's name, and the beneficiary designation is Nicholas's mother. This provision was made prior to his marriage to Whitney. If the Clements sell the growth mutual fund for $14,238, what will be the reported gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts