Question: please do not round. B Derek decides to buy a new car. The dealership offers him a choice of paying $510.00 per month for 5

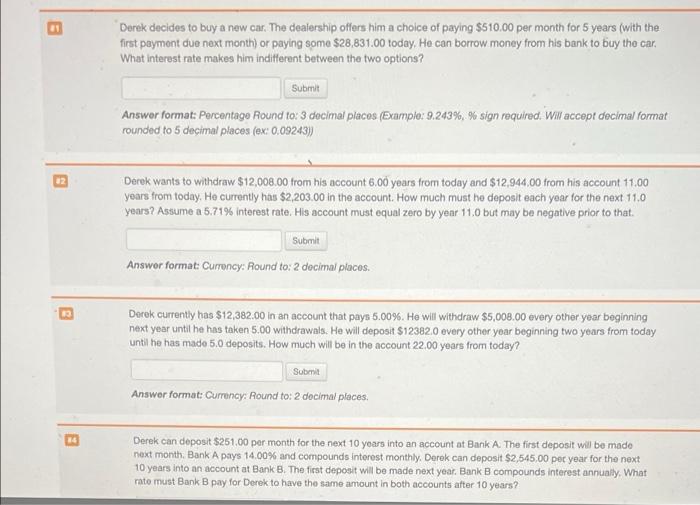

B Derek decides to buy a new car. The dealership offers him a choice of paying $510.00 per month for 5 years with the first payment due next month) or paying some $28.831.00 today. He can borrow money from his bank to buy the car. What interest rate makes him indifferent between the two options? Submit Answer format: Percentage Round to: 3 decimal places (Example: 9.243% % sign required. WW accept decimal format rounded to 5 decimal places (ex: 0.09243) 22 Derek wants to withdraw $12,008.00 from his account 6.00 years from today and $12,944.00 from his account 11.00 years from today, He currently has $2,203.00 in the account. How much must he deposit each year for the next 11.0 years? Assume a 5.71% interest rate. His account must equal zero by year 11.0 but may be negative prior to that. Submit Answer format: Currency: Round to: 2 decimal places. Derek currently has $12,382.00 in an account that pays 5.00%. He will withdraw $5,000.00 every other year beginning next year until he has taken 5.00 withdrawals. He will deposit $12382.0 every other year beginning two years from today until he has made 5.0 deposits. How much will be in the account 22.00 years from today? Suberit Answer format: Currency: Round to: 2 decimal places. Derek can deposit $251.00 per month for the next 10 years into an account at Bank A. The first deposit will be made next month. Bank A pays 14.00% and compounds interest monthly, Derek can deposit $2,545,00 per year for the next 10 years into an account at Bank B. The first deposit will be made next year. Bank B compounds interest annually. What rate must Bank B pay for Derek to have the same amount in both accounts after 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts