Question: please do not round until the end. uud uld SIXIL Our answer. 370000.00 You are thinking about a project to expand your business. In order

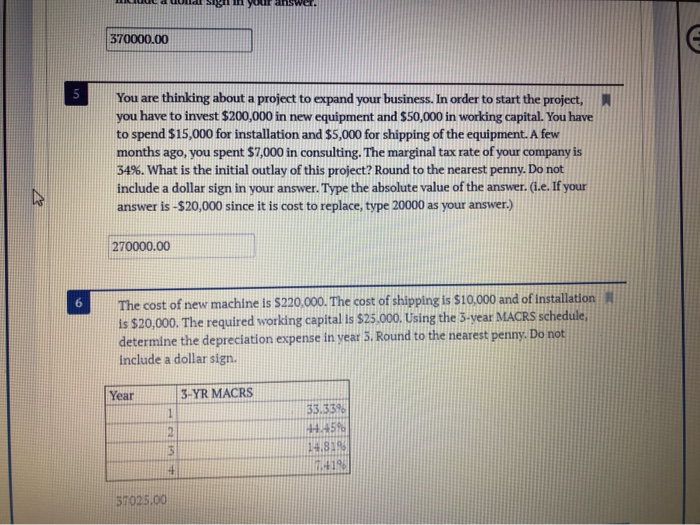

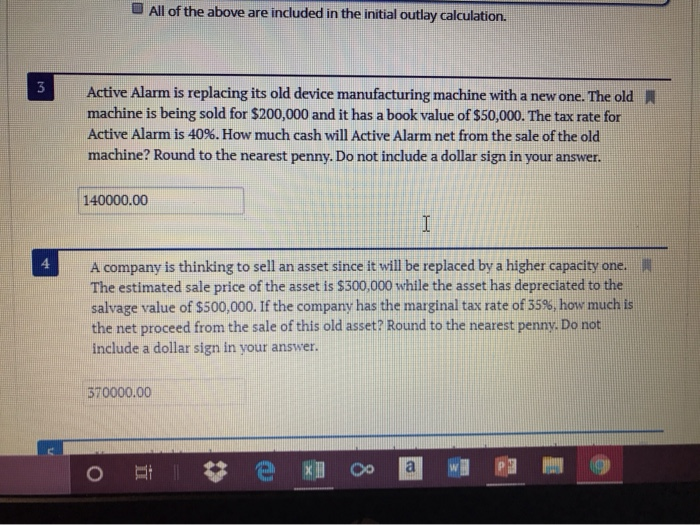

uud uld SIXIL Our answer. 370000.00 You are thinking about a project to expand your business. In order to start the project, you have to invest $200,000 in new equipment and $50,000 in working capital. You have to spend $15,000 for installation and $5,000 for shipping of the equipment. A few months ago, you spent $7,000 in consulting. The marginal tax rate of your company is 34%. What is the initial outlay of this project? Round to the nearest penny. Do not include a dollar sign in your answer. Type the absolute value of the answer. (1.e. If your answer is -$20,000 since it is cost to replace, type 20000 as your answer.) 270000.00 The cost of new machine is $220,000. The cost of shipping is $10,000 and of Installation is $20,000. The required working capital is $25.000. Using the 5-year MACRS schedule, determine the depreciation expense in year 5. Round to the nearest penny. Do not include a dollar sign. Year 3-YR MACRS 31025.00 All of the above are included in the initial outlay calculation. Active Alarm is replacing its old device manufacturing machine with a new one. The old machine is being sold for $200,000 and it has a book value of $50,000. The tax rate for Active Alarm is 40%. How much cash will Active Alarm net from the sale of the old machine? Round to the nearest penny. Do not include a dollar sign in your answer. 140000.00 A company is thinking to sell an asset since it will be replaced by a higher capacity one. The estimated sale price of the asset is $300,000 while the asset has depreciated to the salvage value of $500,000. If the company has the marginal tax rate of 35%, how much is the net proceed from the sale of this old asset? Round to the nearest penny. Do not include a dollar sign in your answer. 570000.00 ote XO a WRI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts