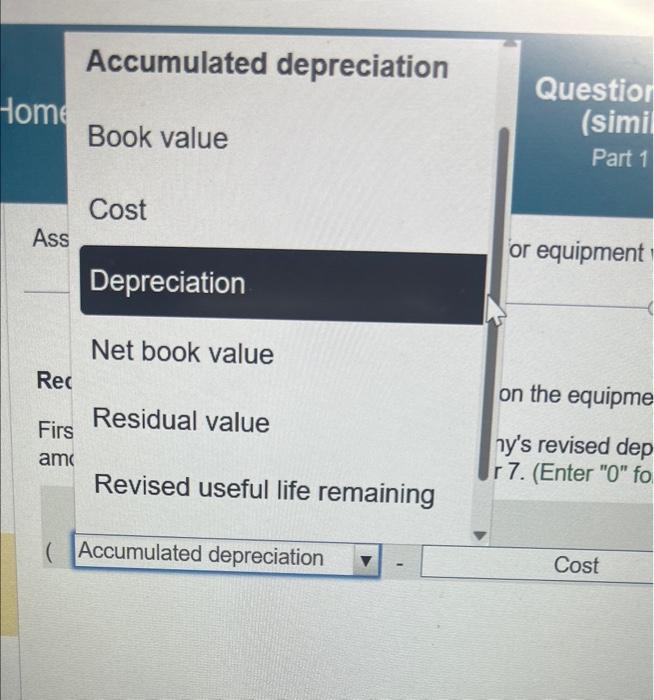

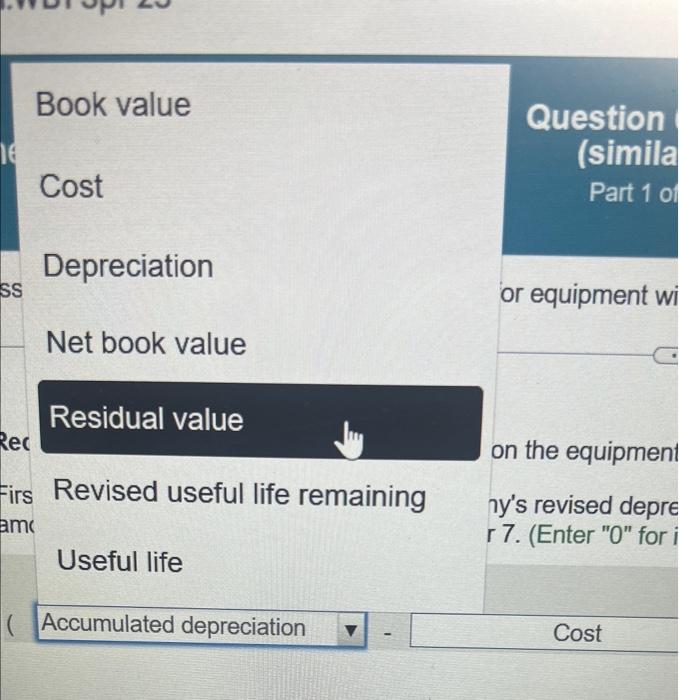

Question: PLEASE DO NOT SELECT ACCUMULATED DEPRECIATION - COST (is NOT CORRECT ANSWER) COST - ACCUMULATED DEPRECIATION ( is NOT THE CORRECT ANSWER) Assume that Smith's

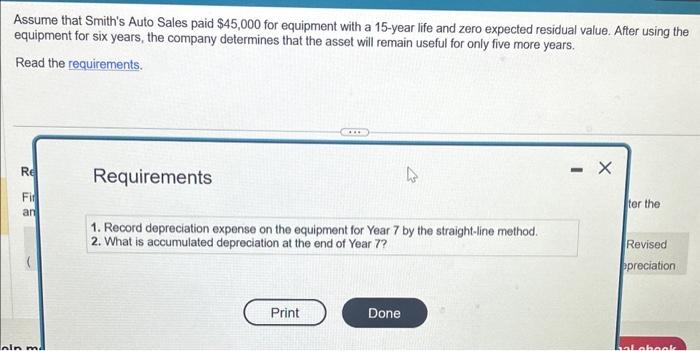

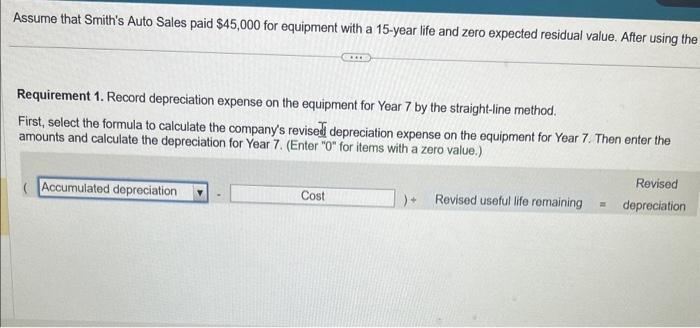

Assume that Smith's Auto Sales paid $45,000 for equipment with a 15-year life and zero expected residual value. After using the equipment for six years, the company determines that the asset will remain useful for only five more years. Read the requirements. Assume that Smith's Auto Sales paid $45,000 for equipment with a 15-year life and zero expected residual value. After using the Requirement 1. Record depreciation expense on the equipment for Year 7 by the straight-line method. First, select the formula to calculate the company's revised depreciation expense on the equipment for Year 7. Then enter the amounts and calculate the depreciation for Year 7. (Enter "0" for items with a zero value.) Accumulated depreciation Book value Cost Ass or equipment Depreciation Net book value Rec on the equipme Firs Residual value ame ny's revised dep Revised useful life remaining 7. (Enter "0" fo Book value Question Cost Depreciation or equipment wi Net book value Residual value on the equipmen Revised useful life remaining yy's revised depre Useful life Accumulated depreciation Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts