Question: PLEASE DO NOT SHARE ANSWER THAT IS STILL IN CHEGG. A construction company is considering acquiring a new earthmover. The purchase price is $110,000, and

PLEASE DO NOT SHARE ANSWER THAT IS STILL IN CHEGG.

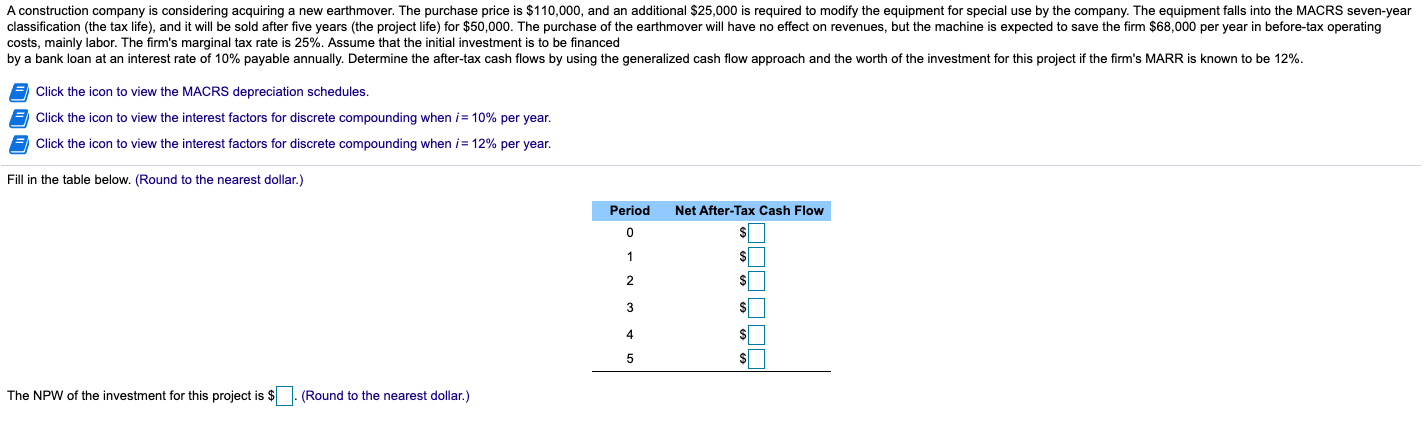

A construction company is considering acquiring a new earthmover. The purchase price is $110,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS seven-year classification (the tax life), and it will be sold after five years the project life) for $50,000. The purchase of the earthmover will have no effect on revenues, but the machine is expected to save the firm $68,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 25%. Assume that the initial investment is to be financed by a bank loan at an interest rate of 10% payable annually. Determine the after-tax cash flows by using the generalized cash flow approach and the worth of the investment for this project if the firm's MARR is known to be 12%. Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when i= 10% per year. Click the icon to view the interest factors for discrete compounding when i = 12% per year. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow 1 $ 2 $ 3 $I 4 5 $ The NPW of the investment for this project is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts