Question: Please do not share other questions like this - they are all similar, not just different numbers, but ithis one is a three-step problem. Please

Please do not share other questions like this - they are all similar, not just different numbers, but ithis one is a three-step problem. Please show how to solve.

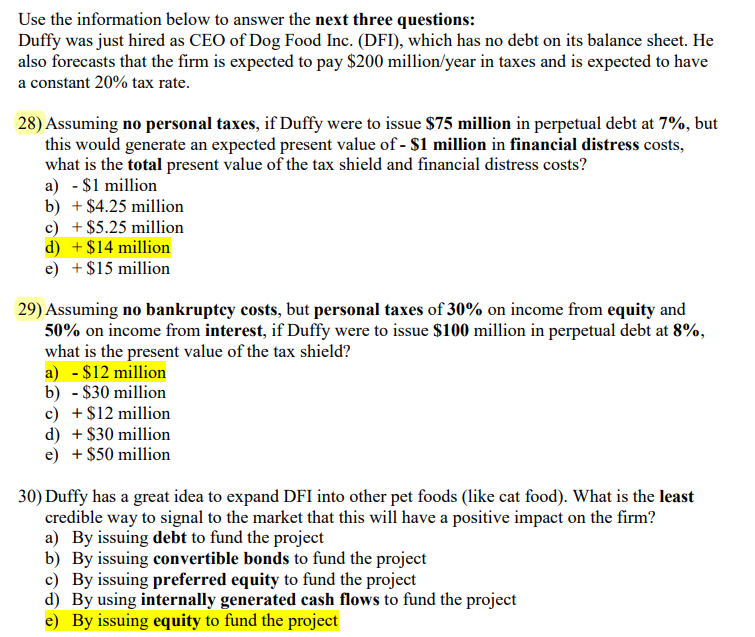

Use the information below to answer the next three questions: Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt on its balance sheet. He also forecasts that the firm is expected to pay $200 million/year in taxes and is expected to have a constant 20% tax rate. 28) Assuming no personal taxes, if Duffy were to issue $75 million in perpetual debt at 7%, but this would generate an expected present value of - $1 million in financial distress costs, what is the total present value of the tax shield and financial distress costs? a) - $1 million b) + $4.25 million c) + $5.25 million d) + $14 million e) + $15 million 29) Assuming no bankruptcy costs, but personal taxes of 30% on income from equity and 50% on income from interest, if Duffy were to issue $100 million in perpetual debt at 8%, what is the present value of the tax shield? a) - $12 million b) - $30 million c) + $12 million d) +$30 million e) + $50 million 30) Duffy has a great idea to expand DFI into other pet foods (like cat food). What is the least credible way to signal to the market that this will have a positive impact on the firm? a) By issuing debt to fund the project b) By issuing convertible bonds to fund the project c) By issuing preferred equity to fund the project d) By using internally generated cash flows to fund the project e) By issuing equity to fund the project Use the information below to answer the next three questions: Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt on its balance sheet. He also forecasts that the firm is expected to pay $200 million/year in taxes and is expected to have a constant 20% tax rate. 28) Assuming no personal taxes, if Duffy were to issue $75 million in perpetual debt at 7%, but this would generate an expected present value of - $1 million in financial distress costs, what is the total present value of the tax shield and financial distress costs? a) - $1 million b) + $4.25 million c) + $5.25 million d) + $14 million e) + $15 million 29) Assuming no bankruptcy costs, but personal taxes of 30% on income from equity and 50% on income from interest, if Duffy were to issue $100 million in perpetual debt at 8%, what is the present value of the tax shield? a) - $12 million b) - $30 million c) + $12 million d) +$30 million e) + $50 million 30) Duffy has a great idea to expand DFI into other pet foods (like cat food). What is the least credible way to signal to the market that this will have a positive impact on the firm? a) By issuing debt to fund the project b) By issuing convertible bonds to fund the project c) By issuing preferred equity to fund the project d) By using internally generated cash flows to fund the project e) By issuing equity to fund the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts