Question: Please do not show work and answers in handwriting, because I do not always understand what is written. Thank you so much! The Hastings Sugar

Please do not show work and answers in handwriting, because I do not always understand what is written. Thank you so much!

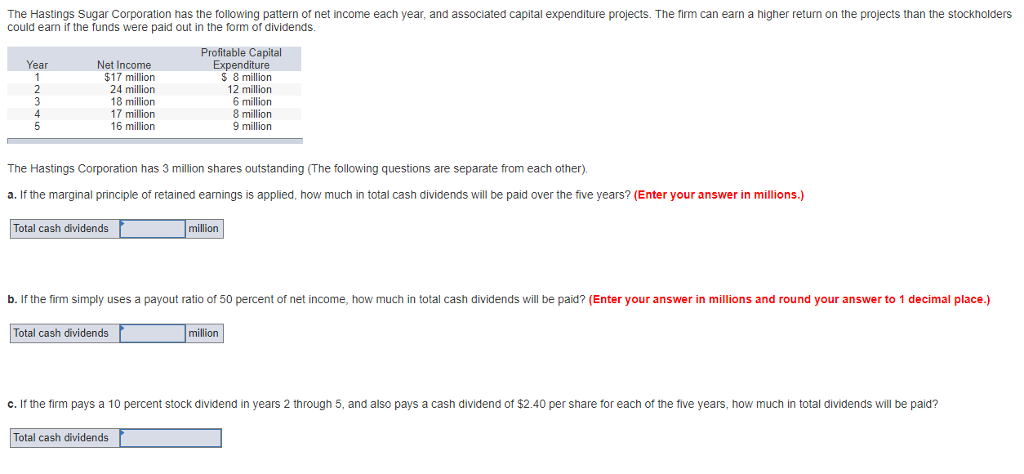

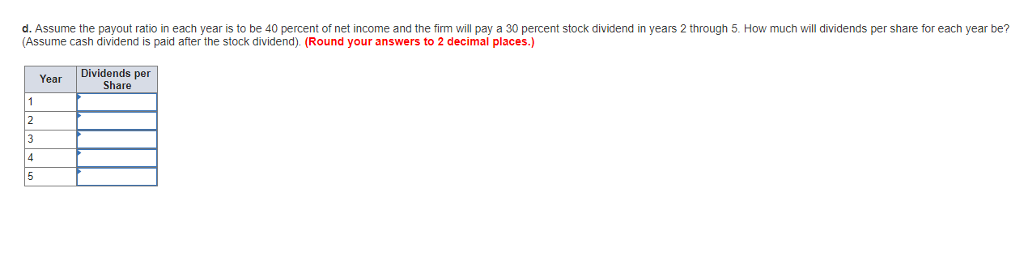

The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders could eanm if the funds were paid out in the form of dividends Profitable Capital Year Net Income $17 million 24 million 18 million 17 million 16 million S 8 million 12 million 6 million 8 million 9 million 4 The Hastings Corporation has 3 million shares outstanding (The following questions are separate from each other). a. If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years? (Enter your answer in millions.) Total cash dividends million b. If the firm simply uses a payout ratio of 50 percent of net income, how much in total cash dividends will be paid? (Enter your answer in millions and round your answer to 1 decimal place.) Total cash dividends million c. If the firm pays a 10 percent stock dividend in years 2 through 5, and also pays a cash dividend of $2.40 per share for each of the tive years, how much in total dividends will be paid? Total cash dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts