Question: PLEASE DO NOT SOLVE WITH EXCEL, I NEED TO KNOW HOW TO DO MANUAL FORMULA TO GET THE ANSWER. PLEASE POST STEP BY STEP AS

PLEASE DO NOT SOLVE WITH EXCEL, I NEED TO KNOW HOW TO DO MANUAL FORMULA TO GET THE ANSWER. PLEASE POST STEP BY STEP AS I NEED TO UNDERSTAND EACH PART OF HOW TO SOLVE FOR THE ANSWER. I WASTED ONE QUESTION ALREADY BECAUSE OF GETTING AN EXCEL SCREENSHOT THAT I DON'T UNDERSTAND. I NEED MANUAL STEPS ONLY. THANK YOU.

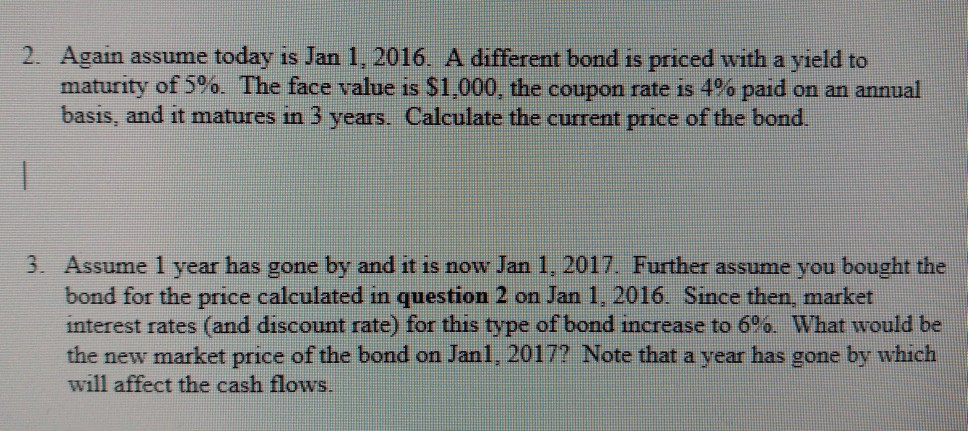

2. Again assume today is Jan 1, 2016. A different bond is priced with a yield to maturity of 5%. The face value is $1,000, the coupon rate is 4% paid on an annual basis, and it matures in 3 vears. Calculate the current price of the bond. 3. Assume 1 year has gone by and it is now Jan 1, 2017. Further assume you bought the bond for the price calculated in question 2 on Jan 1, 2016. Since then, market interest rates (and discount rate) for this type of bond increase to 6%. What would be the new market price of the bond on Janl. 2017? Note that a vear has gone by which will affect the cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts