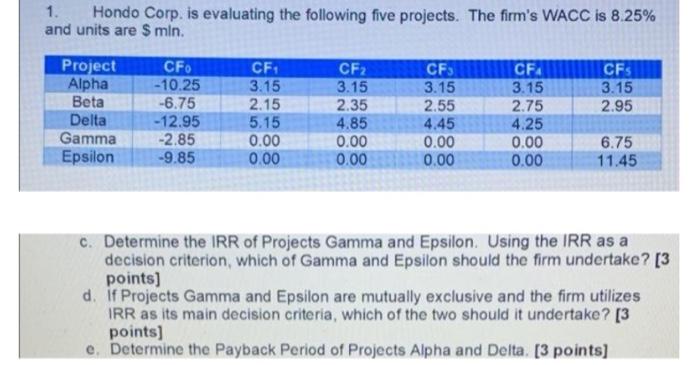

Question: please do not use excel as it gets confusing to undersand 1. Hondo Corp. is evaluating the following five projects. The firm's WACC is 8.25%

1. Hondo Corp. is evaluating the following five projects. The firm's WACC is 8.25% and units are $ min. Project Alpha Beta Delta Gamma Epsilon CF -10.25 -6.75 -12.95 -2.85 -9.85 CFS 3.15 2.95 CF: 3.15 2.15 5.15 0.00 0.00 CF2 3.15 2.35 4.85 0.00 0.00 CF3 3.15 2.55 4.45 0.00 0.00 CFA 3.15 2.75 4.25 0.00 0.00 6.75 11.45 c. Determine the IRR of Projects Gamma and Epsilon. Using the IRR as a decision criterion, which of Gamma and Epsilon should the firm undertake? [3 points) d. If Projects Gamma and Epsilon are mutually exclusive and the firm utilizes IRR as its main decision criteria, which of the two should it undertake? [3 points] e. Determine the Payback period of Projects Alpha and Delta [3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts