Question: Please do not use excel for this question, Maya has purchased her first home for $150,000. She places 20% as a down payment and negotiates

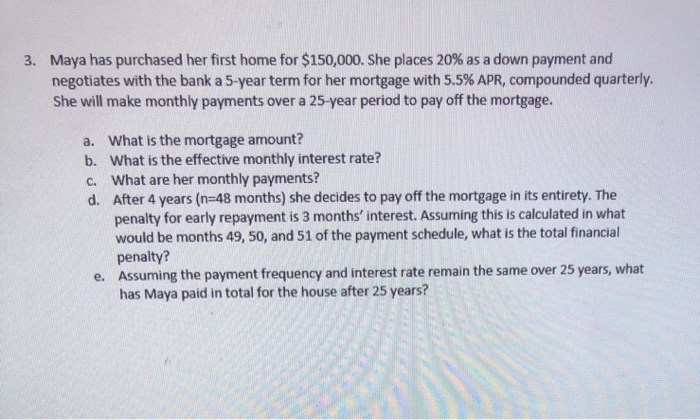

Maya has purchased her first home for $150,000. She places 20% as a down payment and negotiates with the bank a 5-year term for her mortgage with 5.5% APR, compounded quarterly. She will make monthly payments over a 25-year period to pay off the mortgage. 3. a. What is the mortgage amount? b. What is the effective monthly interest rate? c. What are her monthly payments? d. After 4 years (n-48 months) she decides to pay off the mortgage in its entirety. The penalty for early repayment is 3 months' interest. Assuming this is calculated in what would be months 49, 50, and 51 of the payment schedule, what is the total financial penalty? Assuming the payment frequency and interest rate remain the same over 25 years, what has Maya paid in total for the house after 25 years? e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts