Question: Please do not use excel. It should be done in Microsoft Word style, not handwritten. 11.2. Below are the expected returns from both stocks based

Please do not use excel. It should be done in Microsoft Word style, not handwritten.

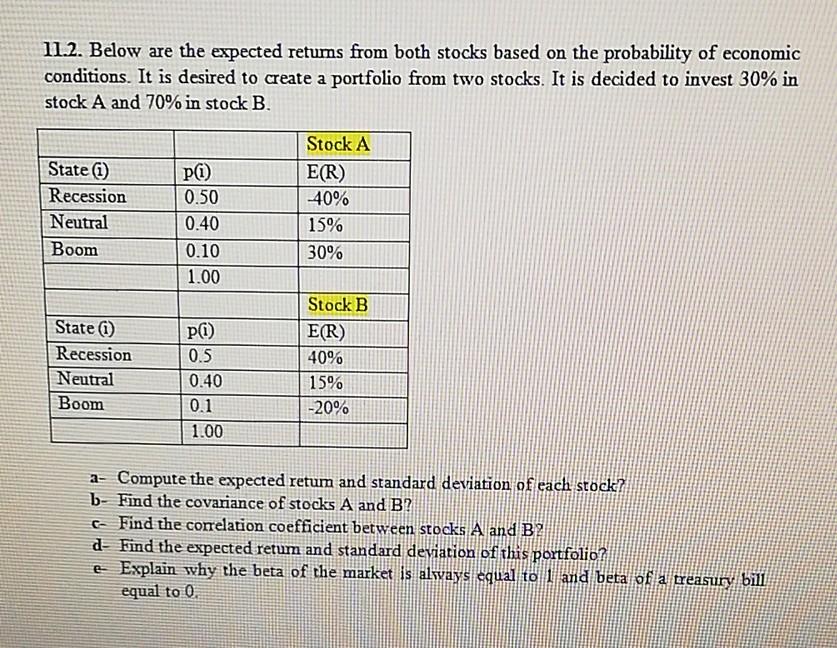

11.2. Below are the expected returns from both stocks based on the probability of economic conditions. It is desired to create a portfolio from two stocks. It is decided to invest 30% in stock A and 70% in stock B. State (1) Recession Neutral Boom p(1) 0.50 0.40 0.10 1.00 Stock A E(R) -40% 15% 30% State (1) Recession Neutral Boom P() 0.5 0.40 0.1 1.00 Stock B E(R) 40% 15% -20% 2- Compute the expected retum and standard deviation of each stock? b- Find the covariance of stocks A and B? Find the correlation coefficient between stocks A and B 2 d- Find the expected retum and standard deviation of this portfolio e Explain why the beta of the market is always equal to 1 and beta of a treasury bill equal to 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts