Question: Please do not use Excel, please show all work and formulas, and steps. Thank you. A sensitivity analysis is performed for a facility with a

Please do not use Excel, please show all work and formulas, and steps. Thank you.

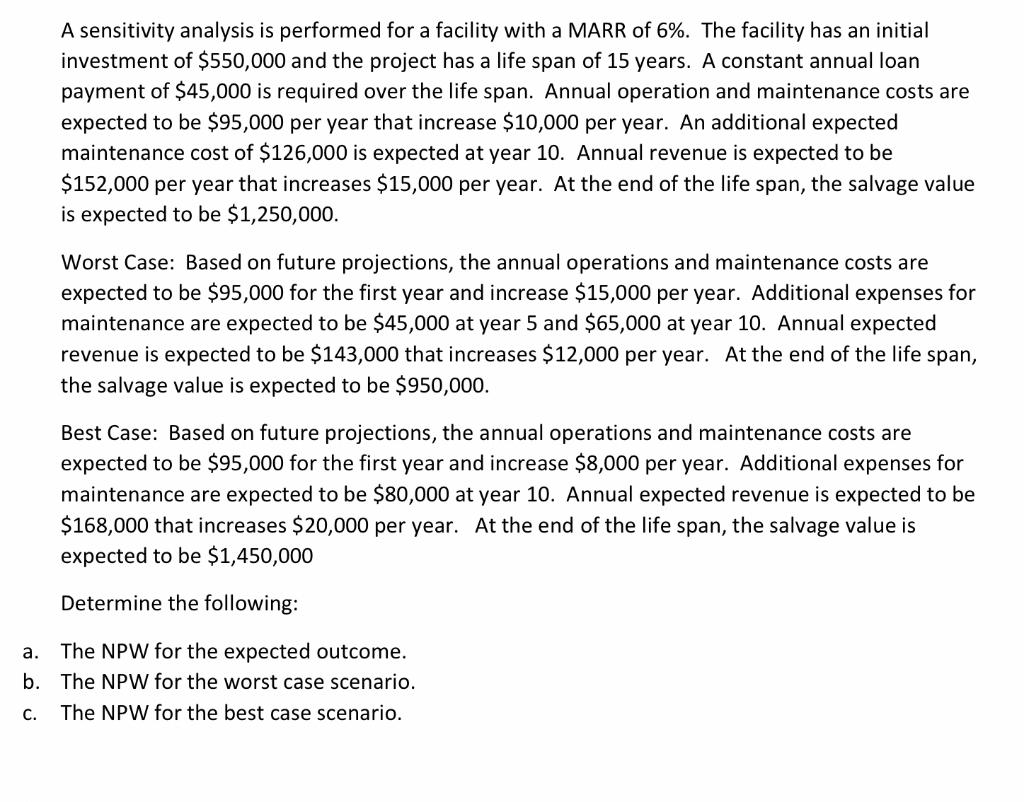

A sensitivity analysis is performed for a facility with a MARR of 6%. The facility has an initial investment of $550,000 and the project has a life span of 15 years. A constant annual loan payment of $45,000 is required over the life span. Annual operation and maintenance costs are expected to be $95,000 per year that increase $10,000 per year. An additional expected maintenance cost of $126,000 is expected at year 10. Annual revenue is expected to be $152,000 per year that increases $15,000 per year. At the end of the life span, the salvage value is expected to be $1,250,000. Worst Case: Based on future projections, the annual operations and maintenance costs are expected to be $95,000 for the first year and increase $15,000 per year. Additional expenses for maintenance are expected to be $45,000 at year 5 and $65,000 at year 10. Annual expected revenue is expected to be $143,000 that increases $12,000 per year. At the end of the life span, the salvage value is expected to be $950,000. Best Case: Based on future projections, the annual operations and maintenance costs are expected to be $95,000 for the first year and in ase $8,000 per year. Additional expenses for maintenance are expected to be $80,000 at year 10. Annual expected revenue is expected to be $168,000 that increases $20,000 per year. At the end of the life span, the salvage value is expected to be $1,450,000 Determine the following: a. The NPW for the expected outcome. b. The NPW for the worst case scenario. The NPW for the best case scenario. A sensitivity analysis is performed for a facility with a MARR of 6%. The facility has an initial investment of $550,000 and the project has a life span of 15 years. A constant annual loan payment of $45,000 is required over the life span. Annual operation and maintenance costs are expected to be $95,000 per year that increase $10,000 per year. An additional expected maintenance cost of $126,000 is expected at year 10. Annual revenue is expected to be $152,000 per year that increases $15,000 per year. At the end of the life span, the salvage value is expected to be $1,250,000. Worst Case: Based on future projections, the annual operations and maintenance costs are expected to be $95,000 for the first year and increase $15,000 per year. Additional expenses for maintenance are expected to be $45,000 at year 5 and $65,000 at year 10. Annual expected revenue is expected to be $143,000 that increases $12,000 per year. At the end of the life span, the salvage value is expected to be $950,000. Best Case: Based on future projections, the annual operations and maintenance costs are expected to be $95,000 for the first year and in ase $8,000 per year. Additional expenses for maintenance are expected to be $80,000 at year 10. Annual expected revenue is expected to be $168,000 that increases $20,000 per year. At the end of the life span, the salvage value is expected to be $1,450,000 Determine the following: a. The NPW for the expected outcome. b. The NPW for the worst case scenario. The NPW for the best case scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts