Question: ***PLEASE DO NOT USE EXCEL SOFTWARE TO COMPLETE THESE QUESTIONS. HANDWRITTEN IS PREFERABLE. THANK YOU! EXCEL CAN BE USED BUT NOT SO MUCH.. THANKS QUESTION

***PLEASE DO NOT USE EXCEL SOFTWARE TO COMPLETE THESE QUESTIONS. HANDWRITTEN IS PREFERABLE. THANK YOU! EXCEL CAN BE USED BUT NOT SO MUCH.. THANKS

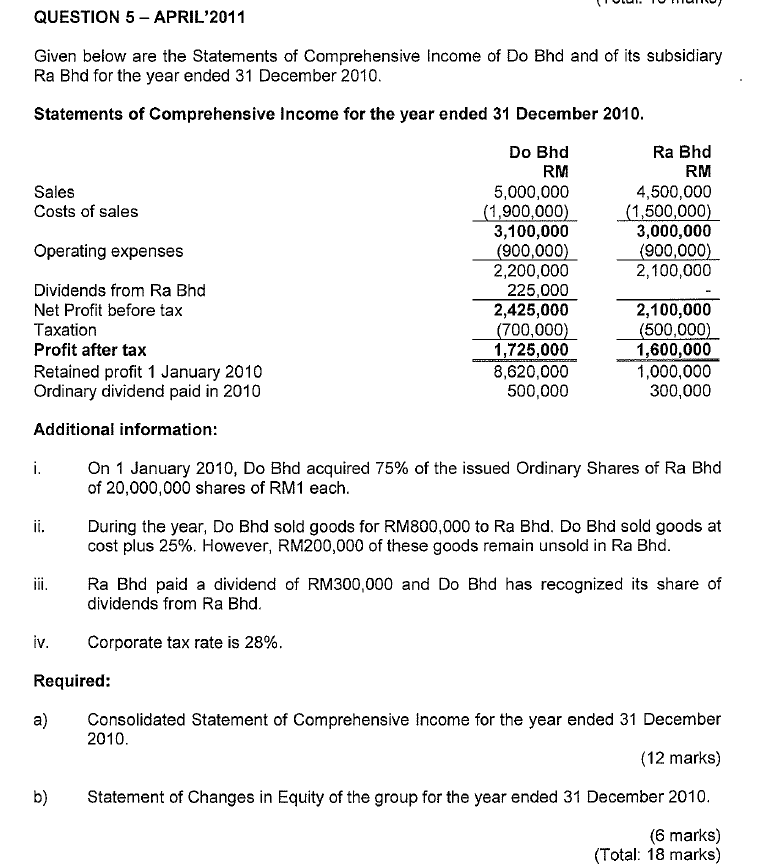

QUESTION 5 - APRIL"2011 Given below are the Statements of Comprehensive Income of Do Bhd and of its subsidiary Ra Bhd for the year ended 31 December 2010. Statements of Comprehensive Income for the year ended 31 December 2010. Sales Costs of sales Do Bhd RM 5,000,000 (1,900,000) 3,100,000 (900,000) 2,200,000 225,000 2,425,000 (700,000) 1,725,000 8,620,000 500,000 Ra Bhd RM 4,500,000 (1,500,000) 3,000,000 (900,000) 2,100,000 Operating expenses Dividends from Ra Bhd Net Profit before tax Taxation Profit after tax Retained profit 1 January 2010 Ordinary dividend paid in 2010 2,100,000 (500,000) 1,600,000 1,000,000 300,000 Additional information: i. ii. On 1 January 2010, Do Bhd acquired 75% of the issued Ordinary Shares of Ra Bhd of 20,000,000 shares of RM1 each. During the year, Do Bhd sold goods for RM800,000 to Ra Bhd. Do Bhd sold goods at cost plus 25%. However, RM200,000 of these goods remain unsold in Ra Bhd. Ra Bhd paid a dividend of RM300,000 and Do Bhd has recognized its share of dividends from Ra Bhd. iii. iv. Corporate tax rate is 28%. Required: a) Consolidated Statement of Comprehensive Income for the year ended 31 December 2010. (12 marks) Statement of Changes in Equity of the group for the year ended 31 December 2010. b) (6 marks) (Total: 18 marks) QUESTION 5 - APRIL"2011 Given below are the Statements of Comprehensive Income of Do Bhd and of its subsidiary Ra Bhd for the year ended 31 December 2010. Statements of Comprehensive Income for the year ended 31 December 2010. Sales Costs of sales Do Bhd RM 5,000,000 (1,900,000) 3,100,000 (900,000) 2,200,000 225,000 2,425,000 (700,000) 1,725,000 8,620,000 500,000 Ra Bhd RM 4,500,000 (1,500,000) 3,000,000 (900,000) 2,100,000 Operating expenses Dividends from Ra Bhd Net Profit before tax Taxation Profit after tax Retained profit 1 January 2010 Ordinary dividend paid in 2010 2,100,000 (500,000) 1,600,000 1,000,000 300,000 Additional information: i. ii. On 1 January 2010, Do Bhd acquired 75% of the issued Ordinary Shares of Ra Bhd of 20,000,000 shares of RM1 each. During the year, Do Bhd sold goods for RM800,000 to Ra Bhd. Do Bhd sold goods at cost plus 25%. However, RM200,000 of these goods remain unsold in Ra Bhd. Ra Bhd paid a dividend of RM300,000 and Do Bhd has recognized its share of dividends from Ra Bhd. iii. iv. Corporate tax rate is 28%. Required: a) Consolidated Statement of Comprehensive Income for the year ended 31 December 2010. (12 marks) Statement of Changes in Equity of the group for the year ended 31 December 2010. b) (6 marks) (Total: 18 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts