Question: Please do not use excel to calculate, need to use formulas by hand! thanks Please do not use excel to calculate, need to use formulas

Please do not use excel to calculate, need to use formulas by hand! thanks

Please do not use excel to calculate, need to use formulas by hand! thanks

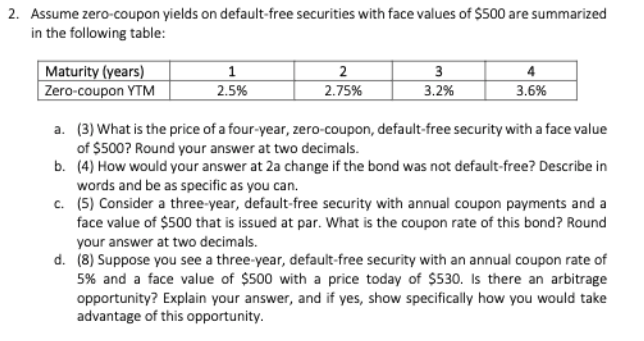

2. Assume zero-coupon yields on default-free securities with face values of $500 are summarized in the following table: Maturity (years) Zero-coupon YTM 1 2.5% 2 2.75% 3 3.2% 4 3.6% a. (3) What is the price of a four-year, zero-coupon, default-free security with a face value of $500? Round your answer at two decimals. b. (4) How would your answer at 2a change if the bond was not default-free? Describe in words and be as specific as you can. C. (5) Consider a three-year, default-free security with annual coupon payments and a face value of $500 that is issued at par. What is the coupon rate of this bond? Round your answer at two decimals. d. (8) Suppose you see a three-year, default-free security with an annual coupon rate of 5% and a face value of $500 with a price today of $530. Is there an arbitrage opportunity? Explain your answer, and if yes, show specifically how you would take advantage of this opportunity. 2. Assume zero-coupon yields on default-free securities with face values of $500 are summarized in the following table: Maturity (years) Zero-coupon YTM 1 2.5% 2 2.75% 3 3.2% 4 3.6% a. (3) What is the price of a four-year, zero-coupon, default-free security with a face value of $500? Round your answer at two decimals. b. (4) How would your answer at 2a change if the bond was not default-free? Describe in words and be as specific as you can. C. (5) Consider a three-year, default-free security with annual coupon payments and a face value of $500 that is issued at par. What is the coupon rate of this bond? Round your answer at two decimals. d. (8) Suppose you see a three-year, default-free security with an annual coupon rate of 5% and a face value of $500 with a price today of $530. Is there an arbitrage opportunity? Explain your answer, and if yes, show specifically how you would take advantage of this opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts