Question: please do not use excel to complete. show all workings on paper. 16 Points for each question Instructions: Kindly answer question one and any other

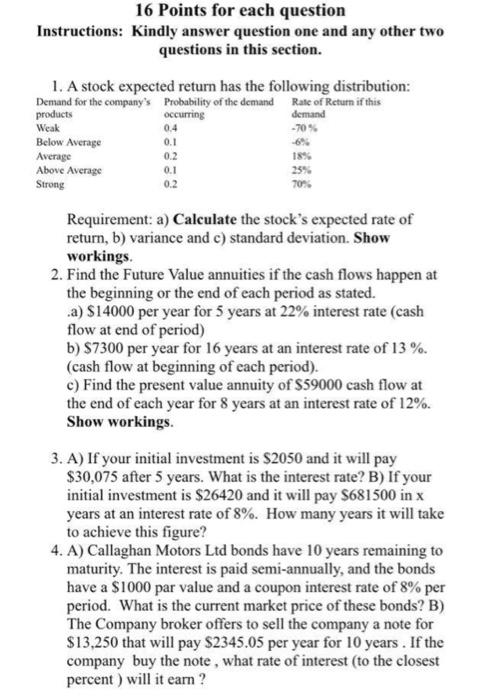

16 Points for each question Instructions: Kindly answer question one and any other two questions in this section. 1. A stock expected return has the following distribution: Demand for the company's Probability of the demand Rate of Return if this products occurring demand Weak 0.4 -70% Below Average 0.1 Average 0.2 Above Average 0.1 25% Strong 0.2 70% Requirement: a) Calculate the stock's expected rate of return, b) variance and c) standard deviation. Show workings. 2. Find the Future Value annuities if the cash flows happen at the beginning or the end of each period as stated. .a) $14000 per year for 5 years at 22% interest rate (cash flow at end of period) b) $7300 per year for 16 years at an interest rate of 13%. (cash flow at beginning of each period). c) Find the present value annuity of $59000 cash flow at the end of each year for 8 years at an interest rate of 12%. Show workings. 3. A) If your initial investment is $2050 and it will pay $30,075 after 5 years. What is the interest rate? B) If your initial investment is $26420 and it will pay $681500 in x years at an interest rate of 8%. How many years it will take to achieve this figure? 4. A) Callaghan Motors Ltd bonds have 10 years remaining to maturity. The interest is paid semi-annually, and the bonds have a $1000 par value and a coupon interest rate of 8% per period. What is the current market price of these bonds? B) The Company broker offers to sell the company a note for $13,250 that will pay $2345.05 per year for 10 years. If the company buy the note, what rate of interest to the closest percent) will it earn? 16 Points for each question Instructions: Kindly answer question one and any other two questions in this section. 1. A stock expected return has the following distribution: Demand for the company's Probability of the demand Rate of Return if this products occurring demand Weak 0.4 -70% Below Average 0.1 Average 0.2 Above Average 0.1 25% Strong 0.2 70% Requirement: a) Calculate the stock's expected rate of return, b) variance and c) standard deviation. Show workings. 2. Find the Future Value annuities if the cash flows happen at the beginning or the end of each period as stated. .a) $14000 per year for 5 years at 22% interest rate (cash flow at end of period) b) $7300 per year for 16 years at an interest rate of 13%. (cash flow at beginning of each period). c) Find the present value annuity of $59000 cash flow at the end of each year for 8 years at an interest rate of 12%. Show workings. 3. A) If your initial investment is $2050 and it will pay $30,075 after 5 years. What is the interest rate? B) If your initial investment is $26420 and it will pay $681500 in x years at an interest rate of 8%. How many years it will take to achieve this figure? 4. A) Callaghan Motors Ltd bonds have 10 years remaining to maturity. The interest is paid semi-annually, and the bonds have a $1000 par value and a coupon interest rate of 8% per period. What is the current market price of these bonds? B) The Company broker offers to sell the company a note for $13,250 that will pay $2345.05 per year for 10 years. If the company buy the note, what rate of interest to the closest percent) will it earn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts