Question: Please do not use excel to solve. Please show step by step solution. 1. The following are the monthly rates of returns for Ohene Djan

Please do not use excel to solve. Please show step by step solution.

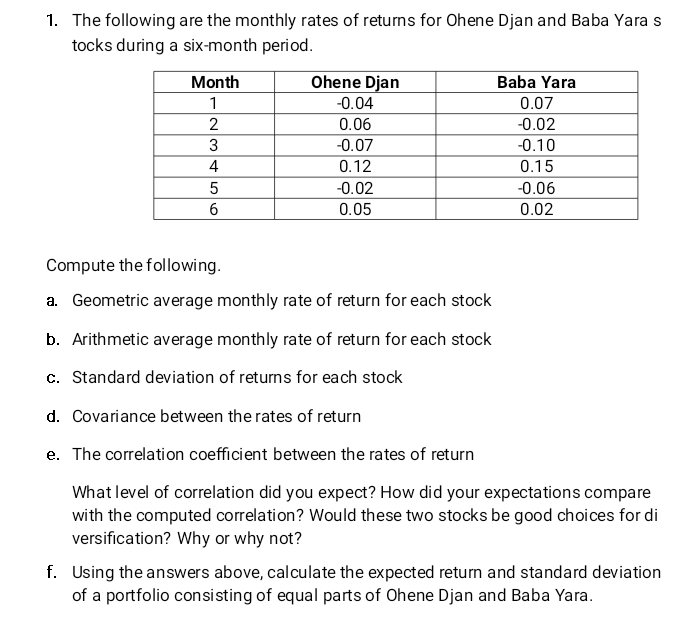

1. The following are the monthly rates of returns for Ohene Djan and Baba Yara s tocks during a six-month period. Month 1 2 3 4 5 6 Ohene Djan -0.04 0.06 -0.07 0.12 -0.02 0.05 Baba Yara 0.07 -0.02 -0.10 0.15 -0.06 0.02 Compute the following. a. Geometric average monthly rate of return for each stock b. Arithmetic average monthly rate of return for each stock c. Standard deviation of returns for each stock d. Covariance between the rates of return e. The correlation coefficient between the rates of return What level of correlation did you expect? How did your expectations compare with the computed correlation? Would these two stocks be good choices for di versification? Why or why not? f. Using the answers above, calculate the expected return and standard deviation of a portfolio consisting of equal parts of Ohene Djan and Baba Yara. 1. The following are the monthly rates of returns for Ohene Djan and Baba Yara s tocks during a six-month period. Month 1 2 3 4 5 6 Ohene Djan -0.04 0.06 -0.07 0.12 -0.02 0.05 Baba Yara 0.07 -0.02 -0.10 0.15 -0.06 0.02 Compute the following. a. Geometric average monthly rate of return for each stock b. Arithmetic average monthly rate of return for each stock c. Standard deviation of returns for each stock d. Covariance between the rates of return e. The correlation coefficient between the rates of return What level of correlation did you expect? How did your expectations compare with the computed correlation? Would these two stocks be good choices for di versification? Why or why not? f. Using the answers above, calculate the expected return and standard deviation of a portfolio consisting of equal parts of Ohene Djan and Baba Yara

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts