Question: Please do not use Excel to solve the problem. I promise to upvote for completed work 1. Let's assume that you are going to purchase

Please do not use Excel to solve the problem. I promise to upvote for completed work

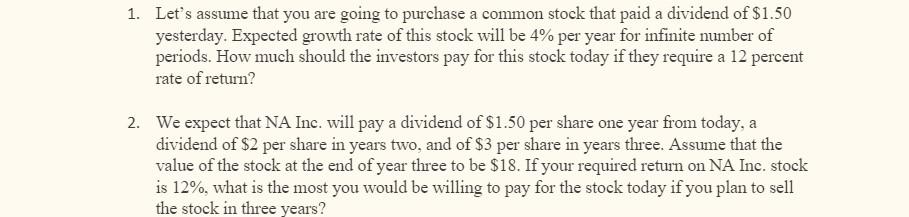

1. Let's assume that you are going to purchase a common stock that paid a dividend of $1.50 yesterday. Expected growth rate of this stock will be 4% per year for infinite number of periods. How much should the investors pay for this stock today if they require a 12 percent rate of return? 2. We expect that NA Inc. will pay a dividend of $1.50 per share one year from today, a dividend of $2 per share in years two, and of $3 per share in years three. Assume that the value of the stock at the end of year three to be $18. If your required return on NA Inc. stock is 12%, what is the most you would be willing to pay for the stock today if you plan to sell the stock in three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts