Question: Please do not use Microsoft Excel, hardwritten or with step without using a program 12-22 The Shellout Corp. owns a piece of petroleum drilling equipment

Please do not use Microsoft Excel, hardwritten or with step without using a program

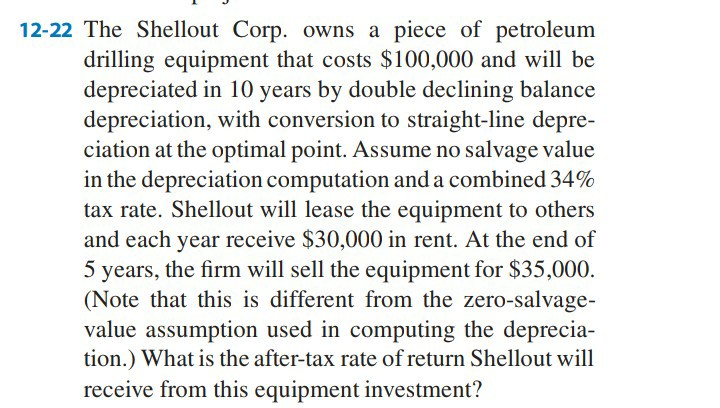

12-22 The Shellout Corp. owns a piece of petroleum drilling equipment that costs $100,000 and will be depreciated in 10 years by double declining balance depreciation, with conversion to straight-line depre- ciation at the optimal point. Assume no salvage value in the depreciation computation and a combined 34% tax rate. Shellout will lease the equipment to others and each year receive $30,000 in rent. At the end of 5 years, the firm will sell the equipment for $35,000. (Note that this is different from the zero-salvage- value assumption used in computing the deprecia- tion.) What is the after-tax rate of return Shellout will receive from this equipment investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts