Question: PLEASE DO NOT USE THE EXCEL. TRYING TO LEARN THE EXAM. NEED TO SEE THE EXPLANATION. (i). You are advising an investor who has $30,000

PLEASE DO NOT USE THE EXCEL. TRYING TO LEARN THE EXAM. NEED TO SEE THE EXPLANATION.

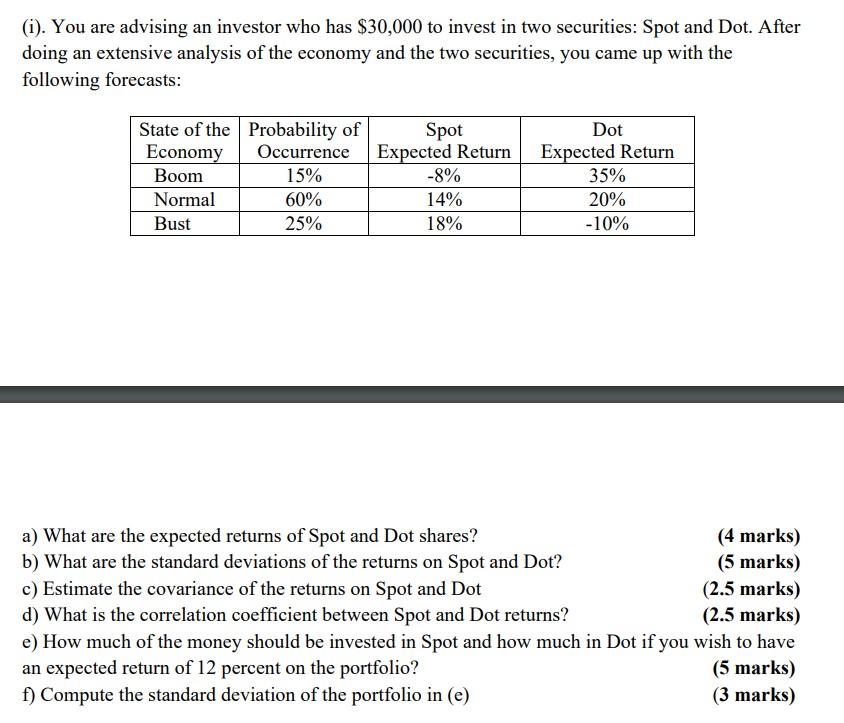

(i). You are advising an investor who has $30,000 to invest in two securities: Spot and Dot. After doing an extensive analysis of the economy and the two securities, you came up with the following forecasts: Dot State of the Probability of Spot Economy Occurrence Expected Return Boom 15% -8% Normal 60% 14% Bust 25% 18% Expected Return 35% 20% -10% a) What are the expected returns of Spot and Dot shares? (4 marks) b) What are the standard deviations of the returns on Spot and Dot? (5 marks) c) Estimate the covariance of the returns on Spot and Dot (2.5 marks) d) What is the correlation coefficient between Spot and Dot returns? (2.5 marks) e) How much of the money should be invested in Spot and how much in Dot if you wish to have an expected return of 12 percent on the portfolio? (5 marks) f) Compute the standard deviation of the portfolio in (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts