Question: Please do not write by hand The bank statement for Greenbrier Furniture Stores showed a balance of $63,289 as of November 30th. The unadjusted balance

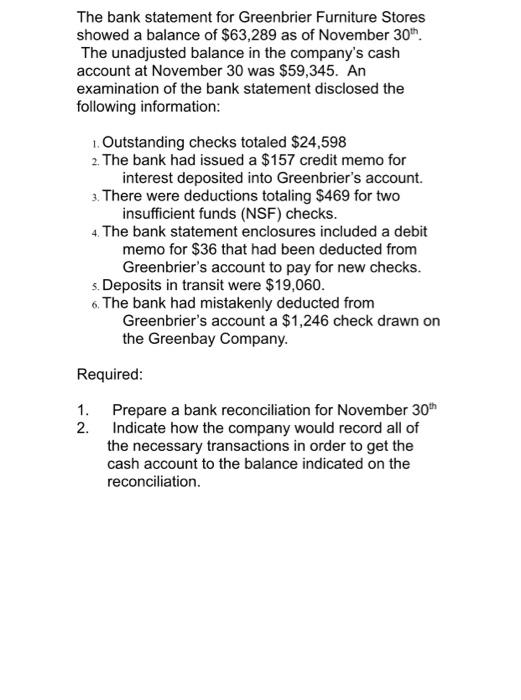

The bank statement for Greenbrier Furniture Stores showed a balance of $63,289 as of November 30th. The unadjusted balance in the company's cash account at November 30 was $59,345. An examination of the bank statement disclosed the following information: 1. Outstanding checks totaled $24,598 2. The bank had issued a $157 credit memo for interest deposited into Greenbrier's account. 3. There were deductions totaling $469 for two insufficient funds (NSF) checks. 4. The bank statement enclosures included a debit memo for $36 that had been deducted from Greenbrier's account to pay for new checks. 5. Deposits in transit were $19,060. 6. The bank had mistakenly deducted from Greenbrier's account a $1,246 check drawn on the Greenbay Company. Required: 1. 2. Prepare a bank reconciliation for November 30th Indicate how the company would record all of the necessary transactions in order to get the cash account to the balance indicated on the reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts