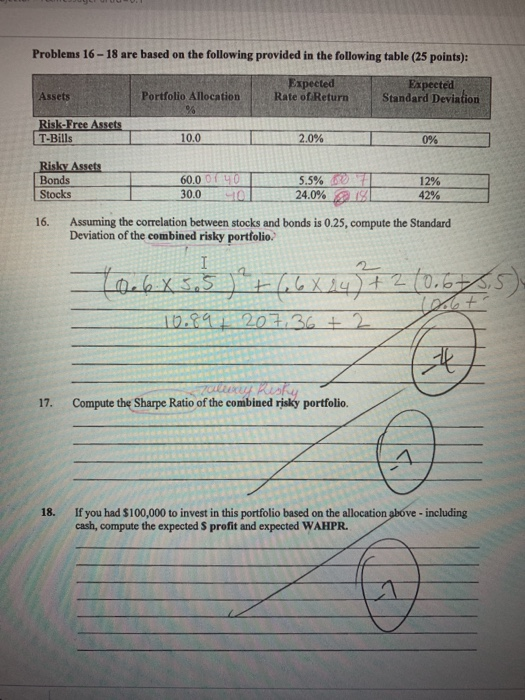

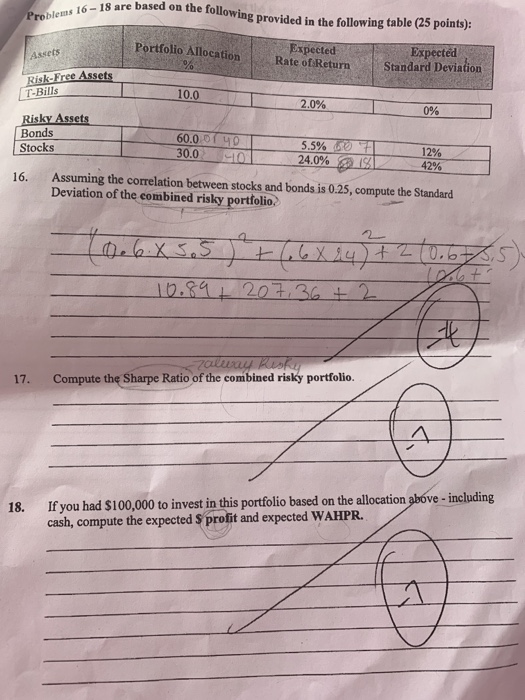

Question: please do number 18 idk how to solve it Problems 16-18 are based on the following provided in the following table (25 points): Portfolio Allocation

Problems 16-18 are based on the following provided in the following table (25 points): Portfolio Allocation Expected Rate of Return Expected Standard Deviation Assets % Risk-Free AsSsets T-Bills 10.0 2.0% 0% Risky Assets Bonds Stocks 60.0f 40 30.0 5.5% 12% 42% Assuming the correlation between stocks and bonds is 0.25, compute the Standard 24.0% 16. Deviation of the combined risky portfolio. 12.81207 36 t2 Zaluray Resky Compute the Sharpe Ratio of the combined risky portfolio. 17. If you had $100,000 to invest in this portfolio based on the allocation above - including 18. cash, compute the expected $ profit and expected WAHPR. Problems 16-18 are based on the following provided in the following table (25 points): Portfolio Allocation Expected Rate of Return Expected Standard Deviation Assets % Risk-Free AsSsets T-Bills 10.0 2.0% 0% Risky Assets Bonds Stocks 60.0f 40 30.0 5.5% 12% 42% Assuming the correlation between stocks and bonds is 0.25, compute the Standard 24.0% 16. Deviation of the combined risky portfolio. 12.81207 36 t2 Zaluray Resky Compute the Sharpe Ratio of the combined risky portfolio. 17. If you had $100,000 to invest in this portfolio based on the allocation above - including 18. cash, compute the expected $ profit and expected WAHPR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts