Question: please do numbers 1 to 6, please show work and solve ASAP. Thank you so much = [1 - (1/1.01254)/.0125 = [1 - (1/1.8154)]/.0125 =

please do numbers 1 to 6, please show work and solve ASAP. Thank you so much

please do numbers 1 to 6, please show work and solve ASAP. Thank you so much

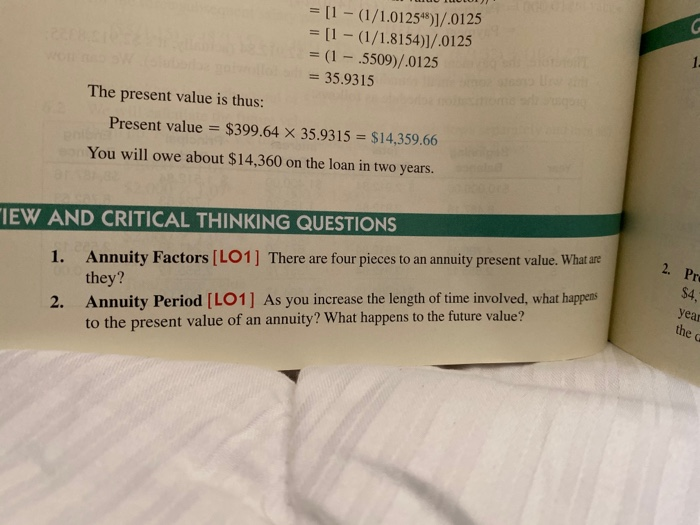

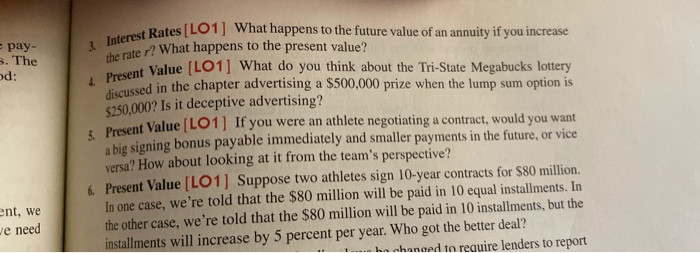

= [1 - (1/1.01254)/.0125 = [1 - (1/1.8154)]/.0125 = (1 - .5509)/.0125 = 35.9315 The present value is thus: Present value = $399.64 X 35.9315 = $14,359.66 You will owe about $14,360 on the loan in two years. "IEW AND CRITICAL THINKING QUESTIONS 1. 2. Pr Annuity Factors (LO1] There are four pieces to an annuity present value. What are they? Annuity Period [LO1] As you increase the length of time involved, what happens to the present value of an annuity? What happens to the future value? $4. year the 3 Interest Rates Lo e pay- 5. The od: 4. Present Value ILO1 Rates [LO1] What happens to the future value of an annuity if you increase ater? What happens to the present value? Value (LO1] What do you think about the Tri-State Megabucks lottery sed in the chapter advertising a $500,000 prize when the lump sum option is $250.000? Is it deceptive advertising? Desent Value (LO1] If you were an athlete negotiating a contract, would you want big signing bonus payable immediately and smaller payments in the future, or vice versa? How about looking at it from the team's perspective? Present Value [LO1] Suppose two athletes sign 10-year contracts for $80 million. In one case, we're told that the $80 million will be paid in 10 equal installments. In the other case, we're told that the $80 million will be paid in 10 installments, but the installments will increase by 5 percent per year. Who got the better deal? 1.....ho nhanced to require lenders to report ent, we Je need

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts