Question: Please do part 9-12 Bootstrapping You have prices on the following semi-annual US Treasury coupon bonds: 9 1 point What is the discount factor for

Please do part 9-12

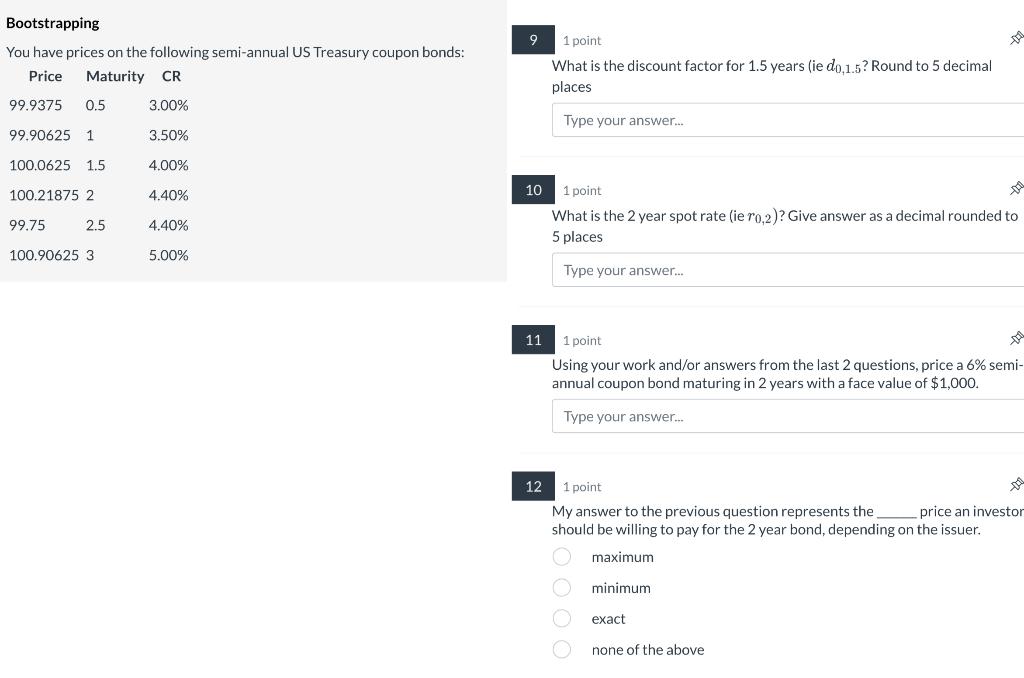

Bootstrapping You have prices on the following semi-annual US Treasury coupon bonds: 9 1 point What is the discount factor for 1.5 years (ie d0,1.5 ? Round to 5 decimal places 10 1 point What is the 2 year spot rate (ie r0,2 )? Give answer as a decimal rounded to 5 places Type your answer... 11 1 point Using your work and/or answers from the last 2 questions, price a 6% semiannual coupon bond maturing in 2 years with a face value of $1,000. 12 1 point My answer to the previous question represents the price an investor should be willing to pay for the 2 year bond, depending on the issuer. maximum minimum exact none of the above Bootstrapping You have prices on the following semi-annual US Treasury coupon bonds: 9 1 point What is the discount factor for 1.5 years (ie d0,1.5 ? Round to 5 decimal places 10 1 point What is the 2 year spot rate (ie r0,2 )? Give answer as a decimal rounded to 5 places Type your answer... 11 1 point Using your work and/or answers from the last 2 questions, price a 6% semiannual coupon bond maturing in 2 years with a face value of $1,000. 12 1 point My answer to the previous question represents the price an investor should be willing to pay for the 2 year bond, depending on the issuer. maximum minimum exact none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts