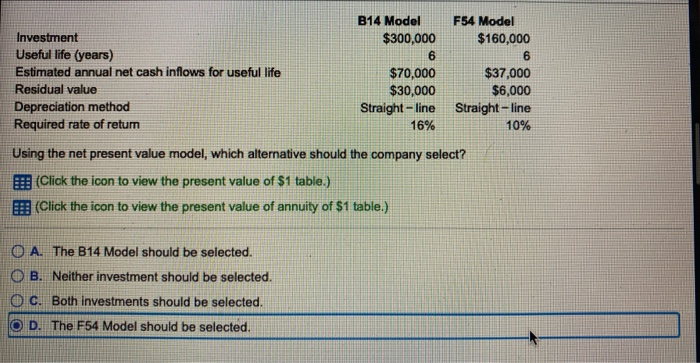

Question: please do part A and B i will give you a good review B14 Model $300,000 F54 Model $160,000 Investment Useful life (years) Estimated annual

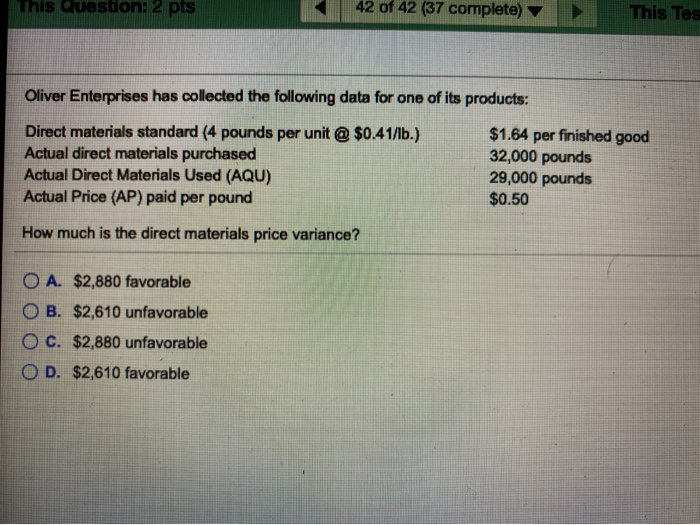

B14 Model $300,000 F54 Model $160,000 Investment Useful life (years) Estimated annual net cash inflows for useful life Residual value Depreciation method Required rate of retum $70,000 $30,000 Straight-line $37,000 $6,000 Straight-line 10% 16% Using the net present value model, which alternative should the company select? (Click the icon to view the present value of $1 table.) (Click the icon to view the present value of annuity of $1 table.) O A. The B14 Model should be selected. OB. Neither investment should be selected. O c. Both investments should be selected. OD. The F54 Model should be selected. mnis Question: 2 pts 42 of 42 (37 complete) This Te Oliver Enterprises has collected the following data for one of its products: Direct materials standard (4 pounds per unit @ $0.41/b.) $1.64 per finished good Actual direct materials purchased 32,000 pounds Actual Direct Materials Used (AQU) 29,000 pounds Actual Price (AP) paid per pound $0.50 How much is the direct materials price variance? O A. $2,880 favorable O B. $2,610 unfavorable O C. $2,880 unfavorable O D. $2,610 favorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts