Question: please do part A and part B MACRS depreciation expense and accounting cash flow Pavlovich Instruments, Inc, a maker of precision telescopes, expects to report

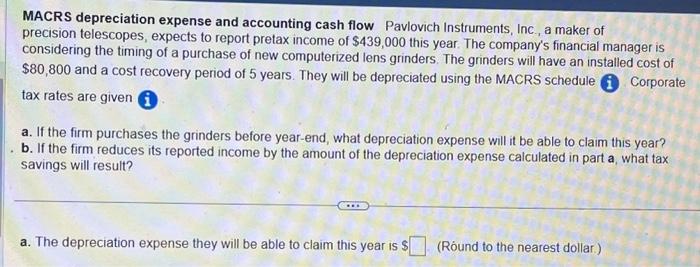

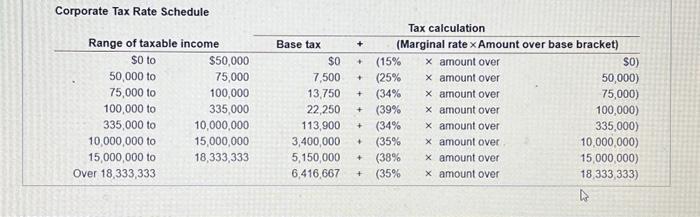

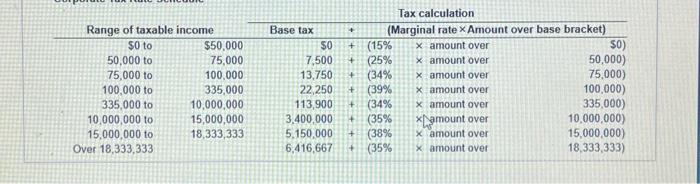

MACRS depreciation expense and accounting cash flow Pavlovich Instruments, Inc, a maker of precision telescopes, expects to report pretax income of $439,000 this year. The company's financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an installed cost of $80,800 and a cost recovery period of 5 years. They will be depreciated using the MACRS schedule tax rates are given Corporate a. If the firm purchases the grinders before year-end, what depreciation expense will it be able to claim this year? b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result? a. The depreciation expense they will be able to claim this year is $ (Round to the nearest dollar.) Coroorate Tax Rate Srheriule Tax calculation \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Range of taxable income } & Base tax & \multirow{2}{*}{+} & \multicolumn{3}{|c|}{ (Marginal rate Amount over base bracket) } \\ \hline$0 to & $50,000 & 50 & & (15% & x amount over & \$0) \\ \hline 50,000 to & 75,000 & 7,500 & + & (25% & x amount over & 50,000) \\ \hline 75,000 to & 100,000 & 13,750 & + & (34% & x amount over & 75.000) \\ \hline 100,000 to & 335,000 & 22,250 & + & (39% & x amount over & 100,000) \\ \hline 335,000 to & 10,000,000 & 113,900 & + & (34% & x amount over & 335,000) \\ \hline 10,000,000 to & 15,000,000 & 3,400,000 & + & 35% & X jamount over & 10,000,000) \\ \hline 15,000,000 to & 18,333,333 & 5,150,000 & + & (38% & x amount over & 15,000,000) \\ \hline Over 18,333,333 & & 6,416,667 & + & 35% & x amount over & 18,333,333) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts