Question: PLEASE DO PART D 3. You are trying to put together a straddle where you buy a call and a put, each with strike $25.

PLEASE DO PART D

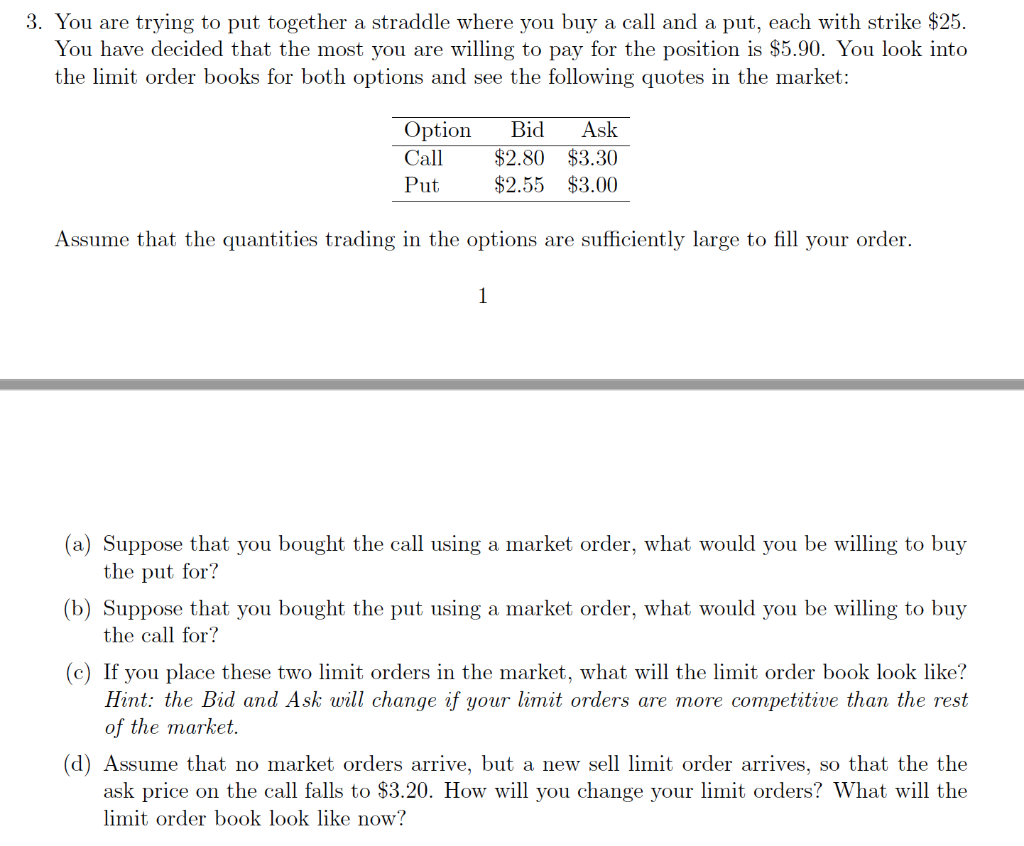

3. You are trying to put together a straddle where you buy a call and a put, each with strike $25. You have decided that the most you are willing to pay for the position is $5.90. You look into the limit order books for both options and see the following quotes in the market: Option Call Put Bid Ask $2.80 $3.30 $2.55 $3.00 Assume that the quantities trading in the options are sufficiently large to fill your order. 1 (a) Suppose that you bought the call using a market order, what would you be willing to buy the put for? (b) Suppose that you bought the put using a market order, what would you be willing to buy the call for? (c) If you place these two limit orders in the market, what will the limit order book look like? Hint: the Bid and Ask will change if your limit orders are more competitive than the rest of the market. (d) Assume that no market orders arrive, but a new sell limit order arrives, so that the the ask price on the call falls to $3.20. How will you change your limit orders? What will the limit order book look like now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts