Question: please do part D in 10 minutes will upvote 8% Question 2 (25 marks) Assume the risk-free rate is 2% and the market return (RM)

please do part D in 10 minutes will upvote

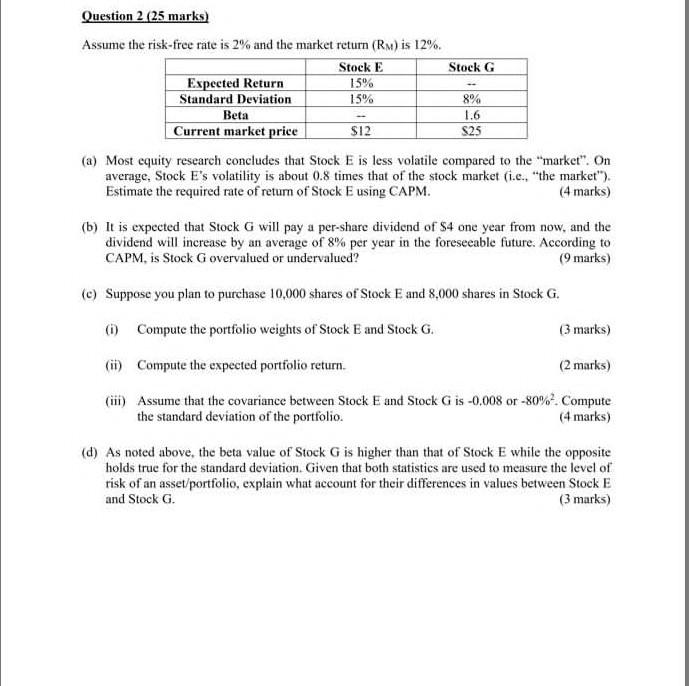

8% Question 2 (25 marks) Assume the risk-free rate is 2% and the market return (RM) is 12% Stock E Stock G Expected Return 15% Standard Deviation 15% Beta 1.6 Current market price S12 S25 (a) Most equity research concludes that Stock E is less volatile compared to the market". On average, Stock E's volatility is about 0.8 times that of the stock market (i.e., "the market"). Estimate the required rate of return of Stock E using CAPM. (4 marks) (b) It is expected that Stock G will pay a per-share dividend of S4 one year from now, and the dividend will increase by an average of 8% per year in the foreseeable future. According to CAPM, is Stock G overvalued or undervalued? (9 marks) (e) Suppose you plan to purchase 10,000 shares of Stock E and 8.000 shares in Stock G. (0) Compute the portfolio weights of Stock E and Stock G. (3 marks) (it) Compute the expected portfolio return. (2 marks) (iii) Assume that the covariance between Stock E and Stock G is -0.008 or -80%. Compute the standard deviation of the portfolio. (4 marks) (d) As noted above, the beta value of Stock G is higher than that of Stock E while the opposite holds true for the standard deviation. Given that both statistics are used to measure the level of risk of an asset/portfolio, explain what account for their differences in values between Stock E and Stock G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts