Question: please do problem in excel and shoe formulas 3. Eastern Shallow, Ltd., is a gold mining company operating a single mine. The present price of

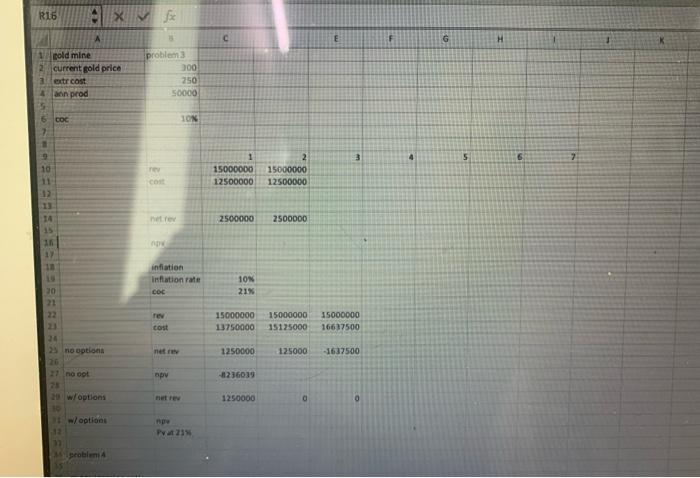

3. Eastern Shallow, Ltd., is a gold mining company operating a single mine. The present price of gold is 5300 an ounce and it costs the company $250 an ounce to produce the gold. Last year, 50,000 ounces were produced and engineers estimate that at this rate of production the mine will be exhausted in seven years. The required rate of return on gold mines is 10%. a. What is the value of the mine? b. Suppose inflation is expected to increase the cost of producing gold by 10% a year but the price of gold does not change becaltie of large sales of stockpiled gold by foreign governments. Furthermore, imagine that the inflation raises the required rate of return to 21%. Now, what is the value of the mine? c. Suppose the company may shut, reopen, or abandon the mine in response to fluctuations in the price of gold. Can the NPV method be used to value the mine under these conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts