Question: Please do problems 8-12 format similar 18J covariance has changed. The following data apply to Problems 8-12. ree mutual funds. The first is A pension

Please do problems 8-12

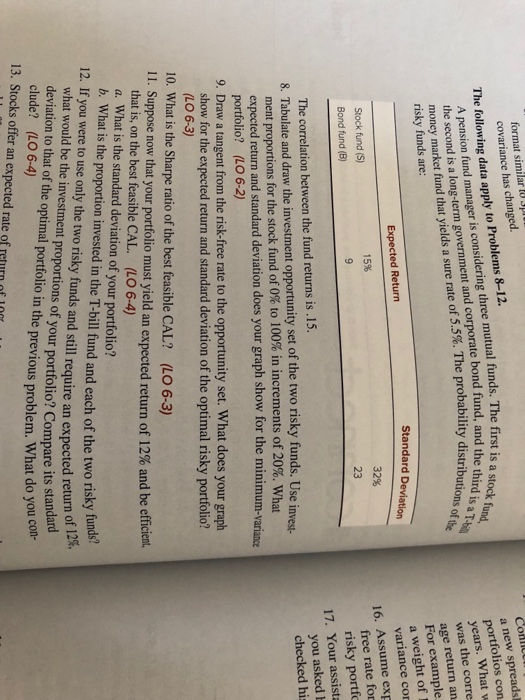

Please do problems 8-12 format similar 18J covariance has changed. The following data apply to Problems 8-12. ree mutual funds. The first is A pension fund manager is considering th the second is a long-term government and corporate bond fund, and the stock und money market fund that yields a sure rate of 5.5%. The probability distributioisa folios con years. What w was the corre age return an For example a weight of 1 variance co risky funds are: Expected Return Standard Deviation Stock fund (S) Bond fund (B) 15% 32% 16. Assume exp free rate for risky portfo 23 The correlation between the fund returns is.15. 8. Tabulate and draw the investment opportunity set of the two risky funds. Use invest 17. Your assista you asked b checked hi ment proportions for the stock fund of 0% to 100% in increments of 20%. What expected return and standard deviation does your graph show for the minimum-variance portfolio? (LO 6-2) 9. Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal risky portfolio? LO 6-3) 10. What is the Sharpe ratio of the best feasible CAL? (LO 6-3) 11. Suppose now that your portfolio must yield an expected return of 12% and be efficient. that is, on the best feasible CAL. (LO 6-4) a, what is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky 12. If you were to use only the two risky funds and still require an expected return of 1 what would be the investment proportions of your portfolio? Compare it deviation to that of the optimal portfolio in the previous problem. What do clude? (LO 6-4) 12%. 13. Stocks offer an expected rate of return of 10 you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts