Question: please do provide detailed explanation for thumsup. Do only if you 100 % sure otherwise don't do QUESTIONS You form a long straddle by buying

please do provide detailed explanation for thumsup. Do only if you 100 % sure otherwise don't do

please do provide detailed explanation for thumsup. Do only if you 100 % sure otherwise don't do

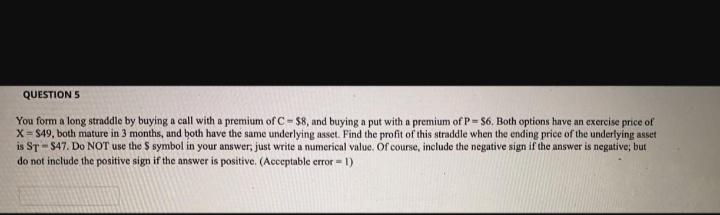

QUESTIONS You form a long straddle by buying a call with a premium of C-58, and buying a put with a premium of P = 56. Both options have an exercise price of X=$49, both mature in 3 months, and both have the same underlying asset. Find the profit of this straddle when the ending price of the underlying asset is ST-547. Do NOT use the symbol in your answer, just write a numerical value. Of course, include the negative sign if the answer is negative; but do not include the positive sign if the answer is positive. (Acceptable error = 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts