Question: please do question 1 &2, format is in an excel 9% discount Calculation question 1. (6) Calculate the monthly payment on the following partially amortized

please do question 1 &2, format is in an excel

please do question 1 &2, format is in an excel  9% discount

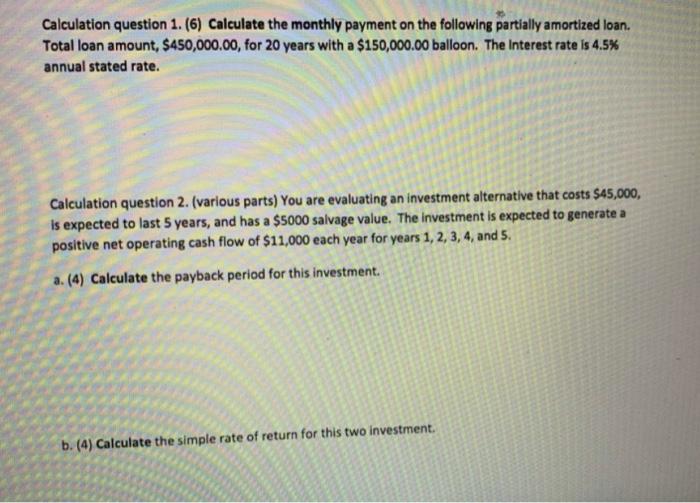

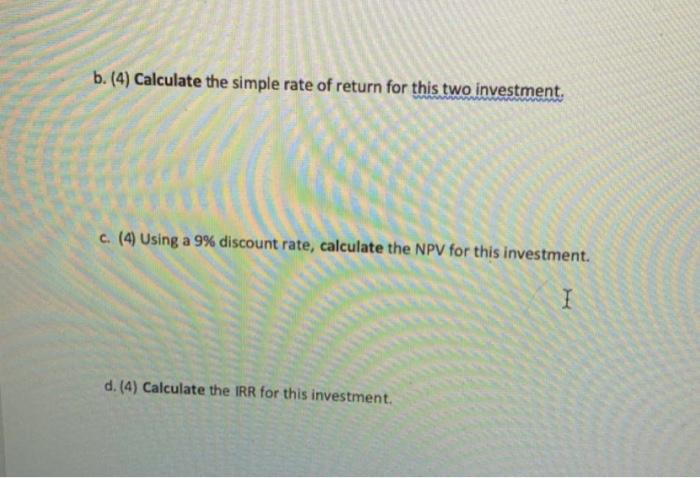

9% discount Calculation question 1. (6) Calculate the monthly payment on the following partially amortized loan. Total loan amount, $450,000.00, for 20 years with a $150,000.00 balloon. The Interest rate is 4.5% annual stated rate. Calculation question 2. (various parts) You are evaluating an investment alternative that costs $45,000, Is expected to last 5 years, and has a $5000 salvage value. The investment is expected to generate a positive net operating cash flow of $11,000 each year for years 1, 2, 3, 4, and 5. a. (4) Calculate the payback period for this investment. b. (4) Calculate the simple rate of return for this two investment. b. (4) Calculate the simple rate of return for this two investment. c. (4) Using a 9% discount rate, calculate the NPV for this investment. I d. (4) Calculate the IRR for this investment. Calculation question 1. (6) Calculate the monthly payment on the following partially amortized loan. Total loan amount, $450,000.00, for 20 years with a $150,000.00 balloon. The Interest rate is 4.5% annual stated rate. Calculation question 2. (various parts) You are evaluating an investment alternative that costs $45,000, Is expected to last 5 years, and has a $5000 salvage value. The investment is expected to generate a positive net operating cash flow of $11,000 each year for years 1, 2, 3, 4, and 5. a. (4) Calculate the payback period for this investment. b. (4) Calculate the simple rate of return for this two investment. b. (4) Calculate the simple rate of return for this two investment. c. (4) Using a 9% discount rate, calculate the NPV for this investment. I d. (4) Calculate the IRR for this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts