Question: please do questions 9 correctly will upvote 9. The price of a stock on February 1 is 119.5. A trader sells 185 put options on

please do questions 9 correctly will upvote

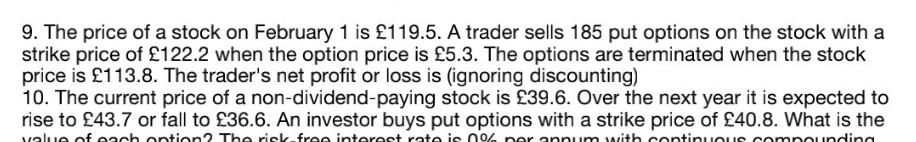

9. The price of a stock on February 1 is 119.5. A trader sells 185 put options on the stock with a strike price of 122.2 when the option price is 5.3. The options are terminated when the stock price is 113.8. The trader's net profit or loss is (ignoring discounting) 10. The current price of a non-dividend-paying stock is 39.6. Over the next year it is expected to rise to 43.7 or fall to 36.6. An investor buys put options with a strike price of 40.8. What is the value of each antion2 The risk free interest rate is 002 er annum with continuou camounding

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock