Question: please do Regression in excel and given explanation for each of them you need information on what? The data shown is for 10 publically traded

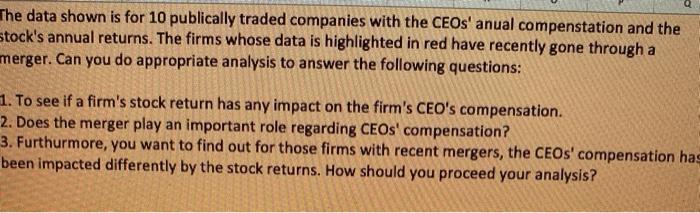

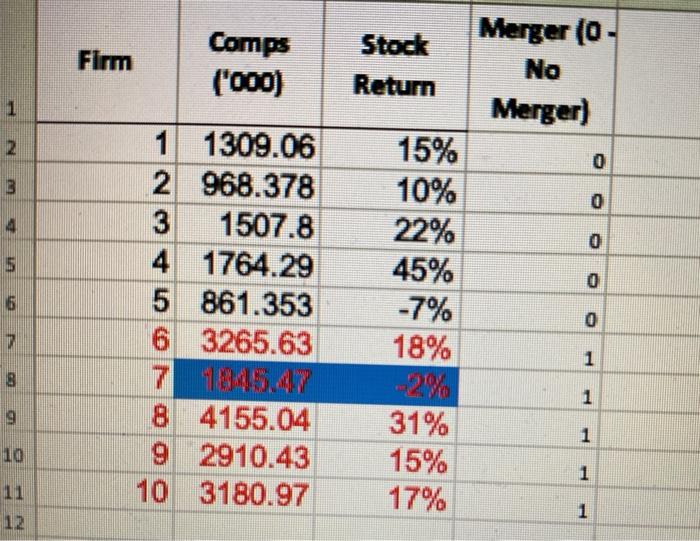

The data shown is for 10 publically traded companies with the CEOs' anual compenstation and the stock's annual returns. The firms whose data is highlighted in red have recently gone through a merger. Can you do appropriate analysis to answer the following questions: 1. To see if a firm's stock return has any impact on the firm's CEO's compensation. 2. Does the merger play an important role regarding CEOs' compensation? 3. Furthurmore, you want to find out for those firms with recent mergers, the CEOs' compensation has been impacted differently by the stock returns. How should you proceed your analysis? Firm Comps ("000) Stock Return Merger (0 No Merger) 1 2 0 3 o 4 0 5 0 6 1 1309.06 2 968.378 3 1507.8 4 1764.29 5 861.353 6 3265.63 7 8 4155.04 9 2910.43 10 3180.97 15% 10% 22% 45% -7% 18% ...21 31% 15% 17% 0 7 3 1 9 1 10 1 11 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts