Question: Please do step by step and manually. ASAP . Q4. A bond is a promised set of future payments from the issuer to the buyer

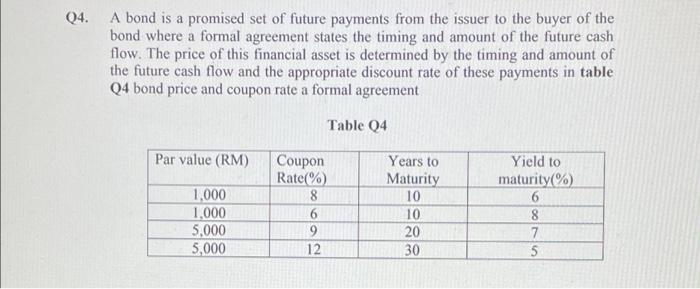

. Q4. A bond is a promised set of future payments from the issuer to the buyer of the bond where a formal agreement states the timing and amount of the future cash flow. The price of this financial asset is determined by the timing and amount of the future cash flow and the appropriate discount rate of these payments in table Q4 bond price and coupon rate a formal agreement Table 04 Par value (RM) 1,000 1.000 5,000 5,000 Coupon Rate(%) 8 6 9 12 Years to Maturity 10 10 20 30 Yield to maturity%) 6 8 7 5 Calculate the price bonds from the table 04 based on the : (a) Semi-annually coupon payments. (8 marks) (b) Monthly coupon payments (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts