Question: Please do step by step calculation. There is same question posted on chegg already but it is 'WRONG Suppose a financial manager buys call options

Please do step by step calculation. There is same question posted on chegg already but it is 'WRONG"

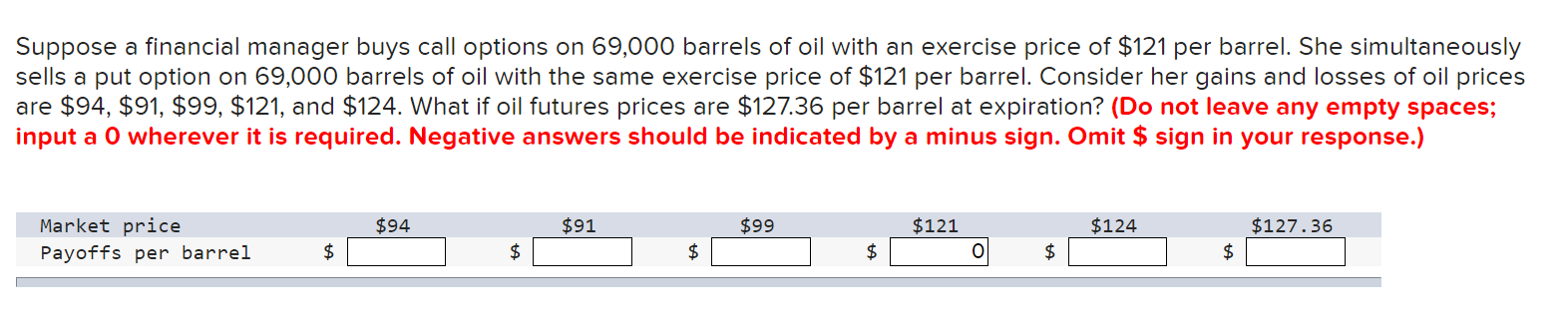

Suppose a financial manager buys call options on 69,000 barrels of oil with an exercise price of $121 per barrel. She simultaneously sells a put option on 69,000 barrels of oil with the same exercise price of $121 per barrel. Consider her gains and losses of oil prices are $94,$91,$99,$121, and $124. What if oil futures prices are $127.36 per barrel at expiration? (Do not leave any empty spaces; input a 0 wherever it is required. Negative answers should be indicated by a minus sign. Omit $ sign in your response.) Suppose a financial manager buys call options on 69,000 barrels of oil with an exercise price of $121 per barrel. She simultaneously sells a put option on 69,000 barrels of oil with the same exercise price of $121 per barrel. Consider her gains and losses of oil prices are $94,$91,$99,$121, and $124. What if oil futures prices are $127.36 per barrel at expiration? (Do not leave any empty spaces; input a 0 wherever it is required. Negative answers should be indicated by a minus sign. Omit $ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts