Question: Please do step by step on paper and NOT excel. 4) a) You are attempting to value a call option with an exercise price of

Please do step by step on paper and NOT excel.

Please do step by step on paper and NOT excel.

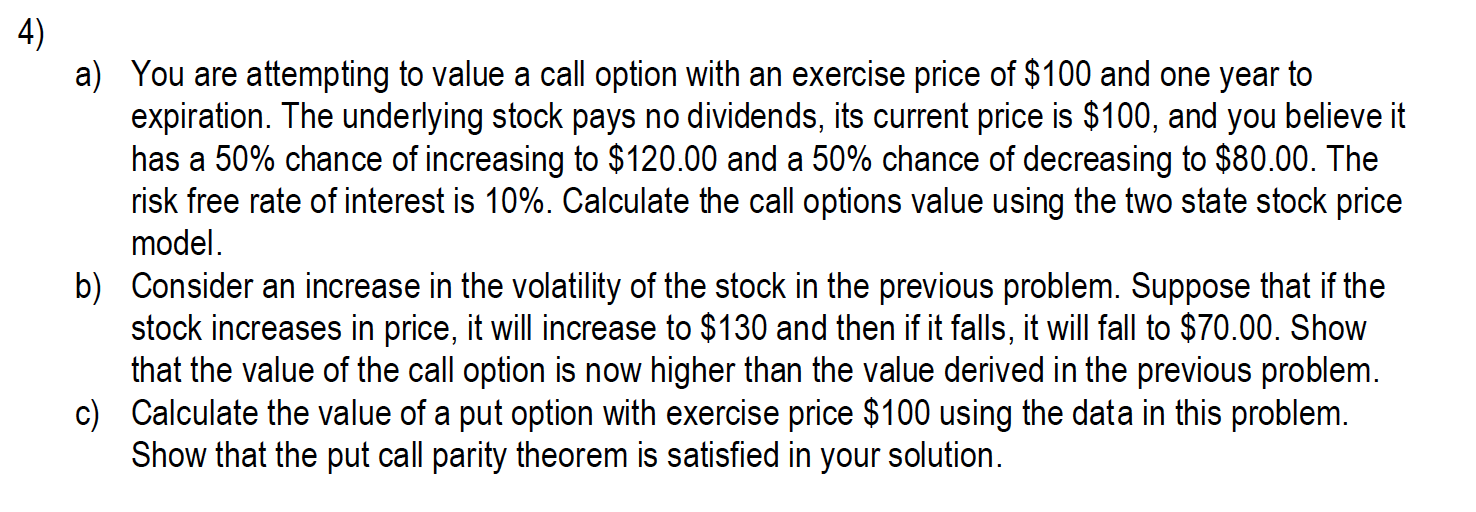

4) a) You are attempting to value a call option with an exercise price of $100 and one year to expiration. The underlying stock pays no dividends, its current price is $100, and you believe it has a 50% chance of increasing to $120.00 and a 50% chance of decreasing to $80.00. The risk free rate of interest is 10%. Calculate the call options value using the two state stock price model. b) Consider an increase in the volatility of the stock in the previous problem. Suppose that if the stock increases in price, it will increase to $130 and then if it falls, it will fall to $70.00. Show that the value of the call option is now higher than the value derived in the previous problem. c) Calculate the value of a put option with exercise price $100 using the data in this problem. Show that the put call parity theorem is satisfied in your solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts