Question: Please do step by step Please do step by step calculation Twilight Corp. desired to raise cash to fund its expansion by issuing long-term bonds.

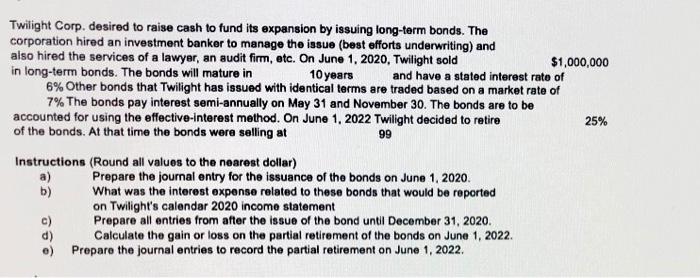

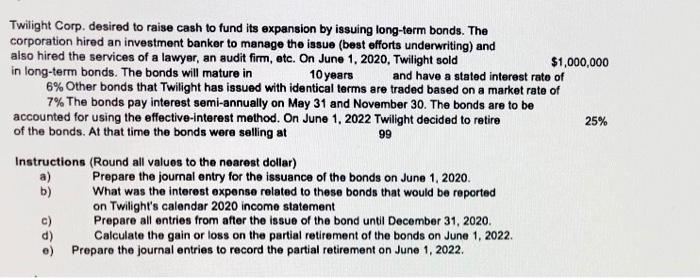

Twilight Corp. desired to raise cash to fund its expansion by issuing long-term bonds. The corporation hired an investment banker to manage the issue (best efforts underwriting) and also hired the services of a lawyer, an audit firm, atc. On June 1, 2020, Twilight sold $1,000,000 in long-term bonds. The bonds will mature in 10 years and have a stated interest rate of 6% Other bonds that Twilight has issued with identical terms are traded based on a market rate of 7% The bonds pay interest semi-annually on May 31 and November 30 . The bonds are to be accounted for using the effective-interest method. On June 1, 2022 Twilight decided to retire 25% of the bonds. At that time the bonds were selling at Instructions (Round all values to the nearest dollar) a) Prepare the joumal entry for the issuance of the bonds on June 1, 2020. b) What was the interest expense related to these bonds that would be reported on Twilight's calendar 2020 income statement c) Prepare all entries from after the issue of the bond until December 31, 2020. d) Calculate the gain or loss on the partial retirement of the bonds on June 1, 2022. e) Prepare the journal entries to record the partial retirement on June 1, 2022. Twilight Corp. desired to raise cash to fund its expansion by issuing long-term bonds. The corporation hired an investment banker to manage the issue (best efforts underwriting) and also hired the services of a lawyer, an audit firm, atc. On June 1, 2020, Twilight sold $1,000,000 in long-term bonds. The bonds will mature in 10 years and have a stated interest rate of 6% Other bonds that Twilight has issued with identical terms are traded based on a market rate of 7% The bonds pay interest semi-annually on May 31 and November 30 . The bonds are to be accounted for using the effective-interest method. On June 1, 2022 Twilight decided to retire 25% of the bonds. At that time the bonds were selling at Instructions (Round all values to the nearest dollar) a) Prepare the joumal entry for the issuance of the bonds on June 1, 2020. b) What was the interest expense related to these bonds that would be reported on Twilight's calendar 2020 income statement c) Prepare all entries from after the issue of the bond until December 31, 2020. d) Calculate the gain or loss on the partial retirement of the bonds on June 1, 2022. e) Prepare the journal entries to record the partial retirement on June 1, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts