Question: Please do the 2 solutions step by step on paper.Thanks. SOUTHERN ELECTRONICS, PART II Steve is well aware of the difference between his will allow

Please do the 2 solutions step by step on paper.Thanks.

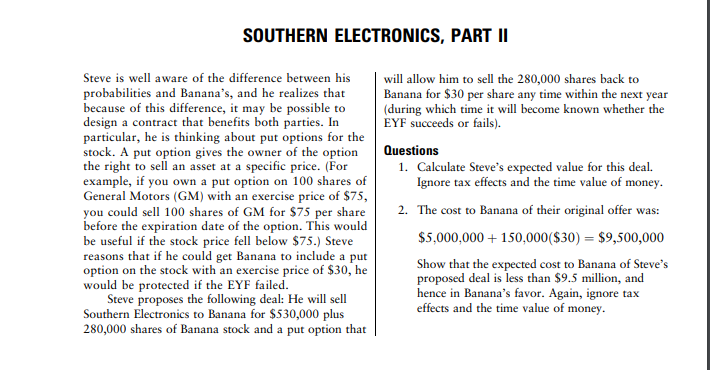

SOUTHERN ELECTRONICS, PART II Steve is well aware of the difference between his will allow him to sell the 280,000 shares back to probabilities and Banana's, and he realizes that Banana for $30 per share any time within the next year because of this difference, it may be possible to (during which time it will become known whether the design a contract that benefits both parties. In EYF succeeds or fails). particular, he is thinking about put options for the stock. A put option gives the owner of the option Questions the right to sell an asset at a specific price. (For 1. Calculate Steve's expected value for this deal. example, if you own a put option on 100 shares of Ignore tax effects and the time value of money. General Motors (GM) with an exercise price of $75, you could sell 100 shares of GM for $75 per share 2. The cost to Banana of their original offer was: before the expiration date of the option. This would be useful if the stock price fell below $75.) Steve $5,000,000 + 150,000($30) = $9,500,000 reasons that if he could get Banana to include a put option on the stock with an exercise price of $30, he Show that the expected cost to Banana of Steve's would be protected if the EYF failed. proposed deal is less than $9.5 million, and Steve proposes the following deal: He will sell hence in Banana's favor. Again, ignore tax Southern Electronics to Banana for $530,000 plus effects and the time value of money. 280,000 shares of Banana stock and a put option that |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts