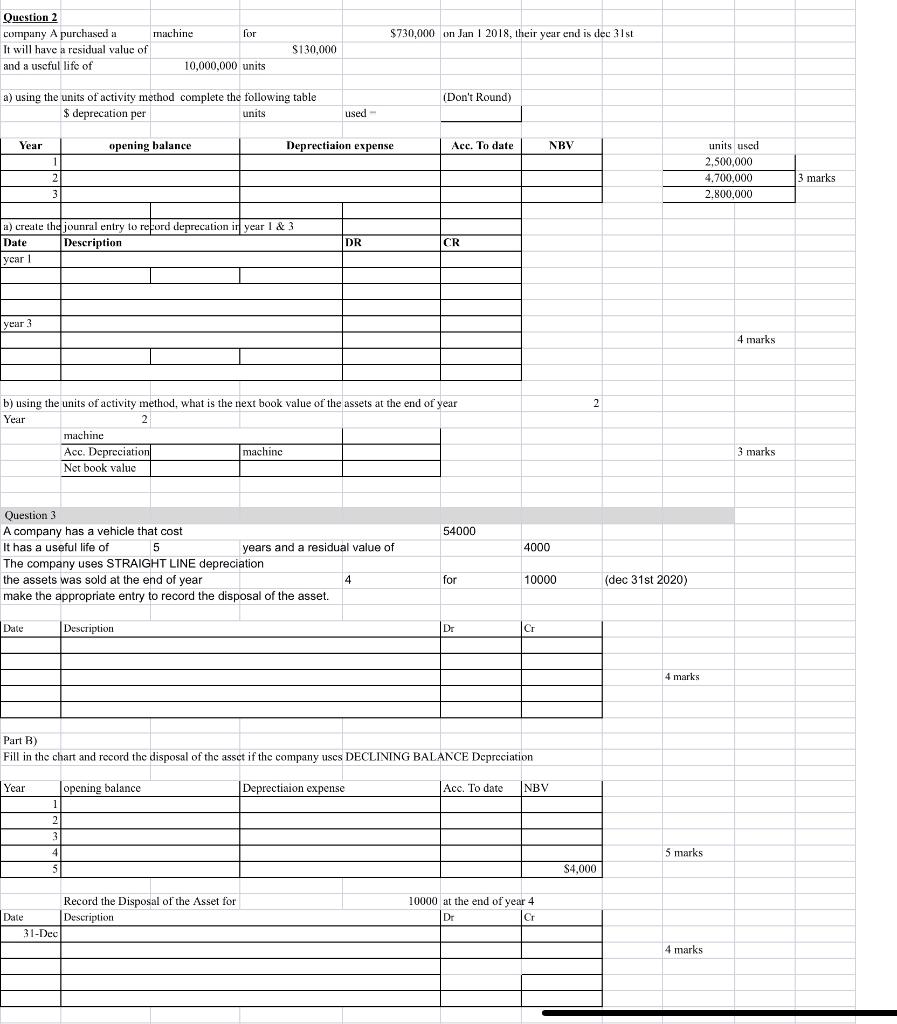

Question: please, do the 2nd question Question 2 begin{tabular}{l|l|l|l|l|l|} hline company A purchased a & machine & for & $730,000 & on Jan 12018 , their

Question 2 \begin{tabular}{l|l|l|l|l|l|} \hline company A purchased a & machine & for & $730,000 & on Jan 12018 , their year end is dec 31 st \\ \hline It will have a residual value of & & $130,000 & & \\ \hline and a useful life of & 10,000,000 units \end{tabular} a) using the units of activity method complete the following table (Don't Round) $ deprecation per units used - \begin{tabular}{|c|c|} \hline units used & \\ \hline 2,500,000 & \\ \hline 4,700,000 & 3 marks \\ \hline 2,800,000 & \\ \hline \end{tabular} 4 marks b) using the units of activity method, what is the next book value of the assets at the end of year 2 3 marks Question 3 A company has a vehicle that cost \begin{tabular}{|l|l|l|l} It has a useful life of & 5 & years and a residual value of & 4000 \end{tabular} The company uses STRAIGHT LINE depreciation the assets was sold at the end of year for 10000 (dec 31st 2020) make the appropriate entry to record the disposal of the asset. \begin{tabular}{|l|l|l|l|l|} Date & Destription & Drr & Cr \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} 4 marks Part B) Fill in the chart and record the disposal of the asset if the company uses DECLINING BALANCE Depreciation 5 marks Record the Disposal of the Asset for 10000 at the end of year 4 Question 2 \begin{tabular}{l|l|l|l|l|l|} \hline company A purchased a & machine & for & $730,000 & on Jan 12018 , their year end is dec 31 st \\ \hline It will have a residual value of & & $130,000 & & \\ \hline and a useful life of & 10,000,000 units \end{tabular} a) using the units of activity method complete the following table (Don't Round) $ deprecation per units used - \begin{tabular}{|c|c|} \hline units used & \\ \hline 2,500,000 & \\ \hline 4,700,000 & 3 marks \\ \hline 2,800,000 & \\ \hline \end{tabular} 4 marks b) using the units of activity method, what is the next book value of the assets at the end of year 2 3 marks Question 3 A company has a vehicle that cost \begin{tabular}{|l|l|l|l} It has a useful life of & 5 & years and a residual value of & 4000 \end{tabular} The company uses STRAIGHT LINE depreciation the assets was sold at the end of year for 10000 (dec 31st 2020) make the appropriate entry to record the disposal of the asset. \begin{tabular}{|l|l|l|l|l|} Date & Destription & Drr & Cr \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} 4 marks Part B) Fill in the chart and record the disposal of the asset if the company uses DECLINING BALANCE Depreciation 5 marks Record the Disposal of the Asset for 10000 at the end of year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts