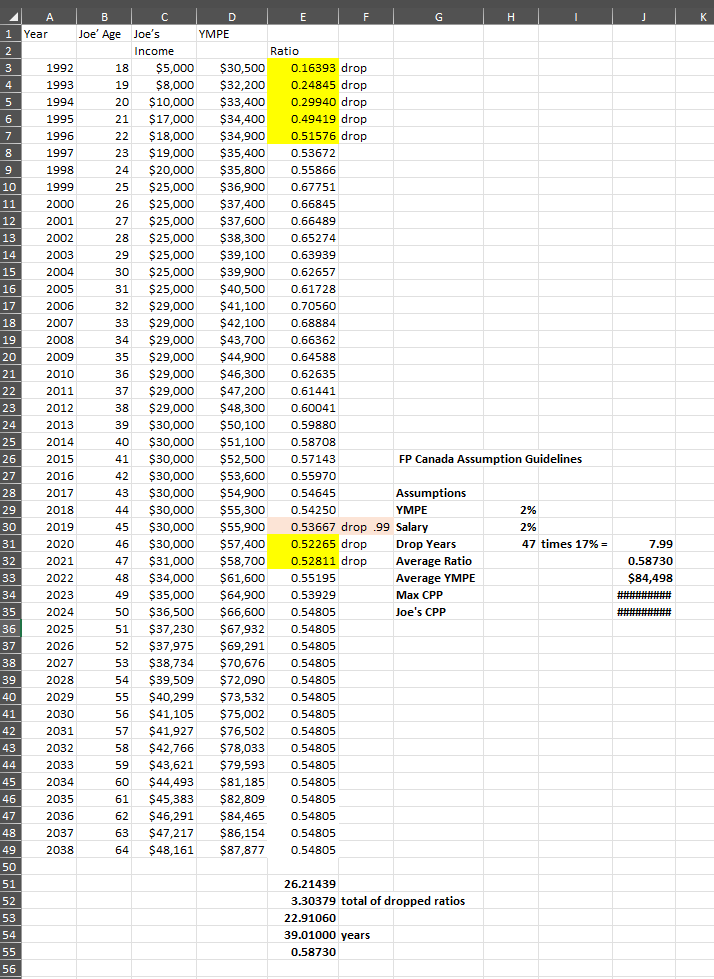

Question: Please do the assignment on Excel SPREETSHEET. I have attached the sample of how the assignment should be finished. It is a sample only. You

Please do the assignment on Excel SPREETSHEET. I have attached the sample of how the assignment should be finished. It is a sample only. You should finish the same calculation for Lisa and Timothy, Retirement Planning Case Study

Part 1 of the assignment should be submitted in excel.

TheCase:Timothy and Lisa Falcone

PersonalInformation- Asat1 January 2024

| Name | Timothy Falcone | Lisa Falcone |

| Date of Birth | January 1st, 1990 | January 1st, 1988 |

| Smoking Status | Non - Smoker | Non- Smoker |

| Health | In good health | In good health |

| Pension | Defined Benefit | Defined Contribution |

Employment

Timothy is a school teacher at St. Thomas Aquinas Secondary School in London. Tim started teaching September 1st, 2016. Tim started teaching as soon as he graduated teachers' college. His starting salary was $71,000. His current salary is $89,940. Tim's salary in indexed to inflation every year on January 1st. Tim sees himself continuing to teach high school until his retirement.

Lisa works for London Life in an office administration role. Lisa has been employed by London Life ever since she graduated from the University of Waterloo in 2012. Lisa is a member of their defined contribution pension. Her current salary is $64,000 per year.

Interests

Timothy and Lisa have always been active. Timothy likes to golf, play volleyball and watch football, while Lisa likes to play soccer and go jogging. Recently they have decided they are going to try pickleball and have joined a league through the City of London.

Major Assets

Timothy and Lisa jointly own a home in London, Ontario that was purchased for $550,000. The house is currently valued at $775,000. They have no intentions of moving and have a mortgage remaining of $110,000, that they expect to pay off over the next 10 years.

Timothy and Lisa saved very little in retirement, as they believe the pensions they have through work will be enough to meet their retirement needs. See Appendix for asset values.

Pension Plans

Timothy is a member of his employer's mandatory defined benefit pension plan. He joined the pension when he was hired at the school board. The plan is based on the average of the best 5 years of employment and will pay Timothy a 1.325% credit per year of service up to the YMPE and 2% on the amount above the YMPE. The pension is indexed to inflation. The pension has a maximum of 35 years of service. The pension has a qualification factor of 85 for early retirement. The plan has a .25% penalty per month for early retirement. The pension plan provides survivor benefits to Lisa in the event ofTimothy's death. Lisa will be entitled to a spousal pension worth 60% of Timothy's pension at the time of his death.

Lisa is a member of a Defined Contribution Pension Plan. She contributes 2% of her salary to the pension plan and her employer contributes 2%. She has been a member of the pension plan since Jan 1, 2014. The plan is invested with a balanced mandate. Timothy and Lisa both have a moderate risk tolerance.

Expenditures

Please see appendix for a list of expenditures that Timothy and Lisa have provided.

Future

Timothy and Lisa have had some discussions with family members who have told them they need to complete a retirement plan. They have decided they want to retire on Jan 1, 2045.

See the following pages for appendices.

Appendix 1 - Timothy and Lisa's expenses

Timothy and Lisa havenothistoricallytracked theirexpenseswell.Theyhaveprovideddetailson specific itemsbelowbutdo not have an accurate breakdown oftheircurrentlifestyle.They haveprovidedyou withtheir gross salariesabove. However, on an annual basis they have a surplus of $10,000 per year.

| Item | Amount | Frequency |

| Mortgage | $1,500 | Monthly |

| Property Tax | $400 | Monthly |

| Entertainment | $325 | Monthly |

| Timothy RRSP | $325 | Monthly |

| Lisa RRSP | $250 | Monthly |

| Groceries | $1,100 | Monthly |

| Heat/Hydro | $300 | Monthly |

| Insurance | $400 | Monthly |

| Cable/Internet | $180 | Monthly |

Appendix 2 - Timothy and Lisa's Assets

House $775,000

Timothy RRSP - $27,250

Lisa RRSP - $28,000

Lisa DC Pension - $62,250

Cars - $33,000

RRSP Carry Forward Room 2023 (amount to be carried forward to 2024)

Timothy - $40,000

Lisa - $32,000 Appendix 3 - Historical Incomes

| Timothy's | Lisa's | Timothy's | Lisa's |

| Age | Age | Income | Income |

| 18 | $0 | $5,000 | |

| 19 | $0 | $5,500 | |

| 18 | 20 | $0 | $5,750 |

| 19 | 21 | $15,000 | $10,000 |

| 20 | 22 | $8,000 | $18,000 |

| 21 | 23 | $8,500 | $37,500 |

| 22 | 24 | $7,800 | $39,000 |

| 23 | 25 | $8,250 | $41,000 |

| 24 | 26 | $10,000 | $42,350 |

| 25 | 27 | $14,000 | $44,000 |

| 26 | 28 | $41,000 | $45,000 |

| 27 | 29 | $73,500 | $47,750 |

| 28 | 30 | $76,000 | $49,000 |

| 29 | 31 | $79,000 | $52,000 |

| 30 | 32 | $81,000 | $54,890 |

| 31 | 33 | $84,250 | $56,000 |

| 32 | 34 | $86,000 | $60,000 |

| 33 | 35 | $87,500 | $62,500 |

Appendix 4 -Retirement Expenditures (in today's dollars)

Tim and Lisa expect that their annual retirement expenditures will be $80,000 after tax in today's dollars. This includes 4 months that they plan to live in Florida during the winter.

ASSIGNMENT INSTRUCTIONS

Your role is as that of a retirement planner. Your objective is to help your clients organize themselves in order to do some financial planning. In the real world, you would do so with clear step by step communication. Details on their income, expenses, assets and liabilities are provided in appendices. Clearly state what assumptions you need to make to complete your assignment.

Part 1 (5 marks out of 25)

- EstimatetheCPPbenefitsthatTimothyandLisawillreceivein retirement,(calculatetheratioof earnings to YMPE) and the OAS benefits they will receive in retirement, in future dollars. Showyour calculations and list any assumptions you are making. Timothy and Lisa plan to take CPP and OAS as soon as they can. Hint:youwillneedtomakeanassumptiononfuture salary increases.

- DeterminetheRPPannualpensionincomethatTimothywillreceivefromhispensionwhenhe retires. Hint:remembertobasethebenefitsonthefuturesalary.

- EstimatethevalueofLisa'sDCPplanwhensheretires.Besuretostateyourassumptions.

| Section | Out of: |

| OAS Estimate | 8 |

| CPP Estimate | 16 |

| DB pension Estimate | 12 |

| DC pension Estimate | 12 |

| TOTAL | 48 |

SAMPLE OF THE ASSIGNMENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts