Question: Please do the Assignment Problem Seven- 4. explain everything with full details. Before the end of March, 2018, both units were rented. The tenants occupying

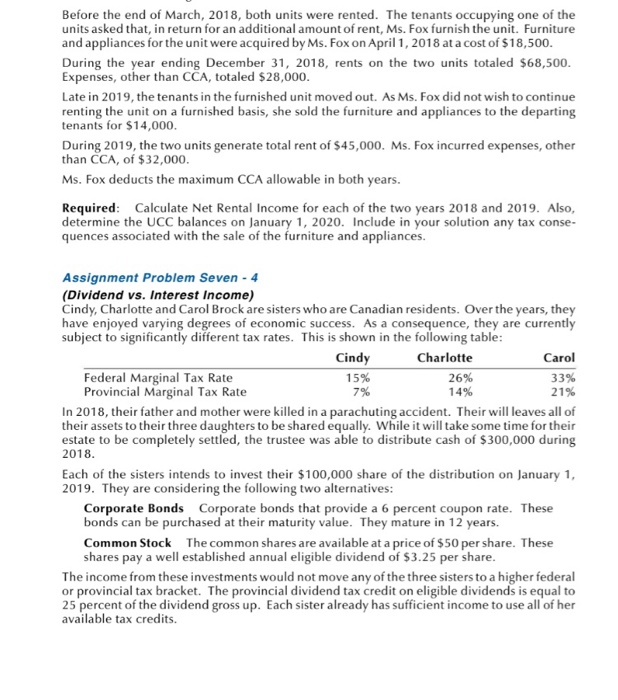

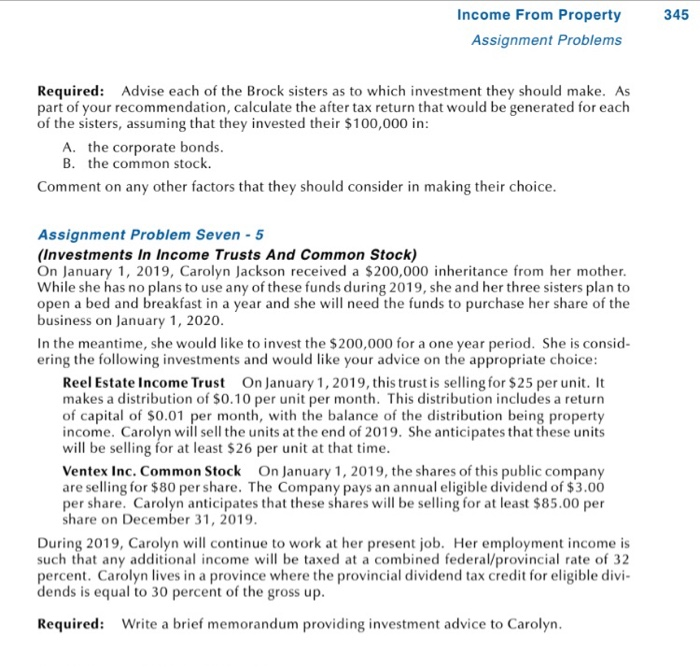

Before the end of March, 2018, both units were rented. The tenants occupying one of the units asked that, in return for an additional amount of rent, Ms. Fox furnish the unit. Furniture and appliances for the unit were acquired by Ms.Fox on April 1, 2018 at a cost of $18,500. During the year ending December 31, 2018, rents on the two units totaled $68,500. Expenses, other than CCA, totaled $28,000. Late in 2019, the tenants in the furnished unit moved out. As Ms. Fox did not wish to continue renting the unit on a furnished basis, she sold the furniture and appliances to the departing tenants for $14,000. During 2019, the two units generate total rent of $45,000. Ms. Fox incurred expenses, other than CCA, of $32,000. Ms. Fox deducts the maximum CCA allowable in both years. Required: Calculate Net Rental Income for each of the two years 2018 and 2019. Also, determine the UCC balances on January 1, 2020. Include in your solution any tax conse- quences associated with the sale of the furniture and appliances. Assignment Problem Seven - 4 (Dividend vs. Interest Income) Cindy, Charlotte and Carol Brock are sisters who are Canadian residents. Over the years, they have enjoyed varying degrees of economic success. As a consequence, they are currently subject to significantly different tax rates. This is shown in the following table: Cindy Charlotte Carol Federal Marginal Tax Rate 15% 26% 33% Provincial Marginal Tax Rate 7% 14% 21% In 2018, their father and mother were killed in a parachuting accident. Their will leaves all of their assets to their three daughters to be shared equally. While it will take some time for their estate to be completely settled, the trustee was able to distribute cash of $300,000 during 2018. Each of the sisters intends to invest their $100,000 share of the distribution on January 1, 2019. They are considering the following two alternatives: Corporate Bonds Corporate bonds that provide a 6 percent coupon rate. These bonds can be purchased at their maturity value. They mature in 12 years. Common Stock The common shares are available at a price of $50 per share. These shares pay a well established annual eligible dividend of $3.25 per share. The income from these investments would not move any of the three sisters to a higher federal or provincial tax bracket. The provincial dividend tax credit on eligible dividends is equal to 25 percent of the dividend gross up. Each sister already has sufficient income to use all of her available tax credits. 345 Income From Property Assignment Problems Required: Advise each of the Brock sisters as to which investment they should make. As part of your recommendation, calculate the after tax return that would be generated for each of the sisters, assuming that they invested their $100,000 in: A. the corporate bonds. B. the common stock. Comment on any other factors that they should consider in making their choice. Assignment Problem Seven - 5 (Investments In Income Trusts And Common Stock) On January 1, 2019, Carolyn Jackson received a $200,000 inheritance from her mother. While she has no plans to use any of these funds during 2019, she and her three sisters plan to open a bed and breakfast in a year and she will need the funds to purchase her share of the business on January 1, 2020. In the meantime, she would like to invest the $200,000 for a one year period. She is consid- ering the following investments and would like your advice on the appropriate choice: Reel Estate Income Trust On January 1, 2019, this trust is selling for $25 per unit. It makes a distribution of $0.10 per unit per month. This distribution includes a return of capital of $0.01 per month, with the balance of the distribution being property income. Carolyn will sell the units at the end of 2019. She anticipates that these units will be selling for at least $26 per unit at that time. Ventex Inc. Common Stock On January 1, 2019, the shares of this public company are selling for $ 80 per share. The Company pays an annual eligible dividend of $3.00 per share. Carolyn anticipates that these shares will be selling for at least $85.00 per share on December 31, 2019. During 2019, Carolyn will continue to work at her present job. Her employment income is such that any additional income will be taxed at a combined federal/provincial rate of 32 percent. Carolyn lives in a province where the provincial dividend tax credit for eligible divi- dends is equal to 30 percent of the gross up. Required: Write a brief memorandum providing investment advice to Carolyn. Before the end of March, 2018, both units were rented. The tenants occupying one of the units asked that, in return for an additional amount of rent, Ms. Fox furnish the unit. Furniture and appliances for the unit were acquired by Ms.Fox on April 1, 2018 at a cost of $18,500. During the year ending December 31, 2018, rents on the two units totaled $68,500. Expenses, other than CCA, totaled $28,000. Late in 2019, the tenants in the furnished unit moved out. As Ms. Fox did not wish to continue renting the unit on a furnished basis, she sold the furniture and appliances to the departing tenants for $14,000. During 2019, the two units generate total rent of $45,000. Ms. Fox incurred expenses, other than CCA, of $32,000. Ms. Fox deducts the maximum CCA allowable in both years. Required: Calculate Net Rental Income for each of the two years 2018 and 2019. Also, determine the UCC balances on January 1, 2020. Include in your solution any tax conse- quences associated with the sale of the furniture and appliances. Assignment Problem Seven - 4 (Dividend vs. Interest Income) Cindy, Charlotte and Carol Brock are sisters who are Canadian residents. Over the years, they have enjoyed varying degrees of economic success. As a consequence, they are currently subject to significantly different tax rates. This is shown in the following table: Cindy Charlotte Carol Federal Marginal Tax Rate 15% 26% 33% Provincial Marginal Tax Rate 7% 14% 21% In 2018, their father and mother were killed in a parachuting accident. Their will leaves all of their assets to their three daughters to be shared equally. While it will take some time for their estate to be completely settled, the trustee was able to distribute cash of $300,000 during 2018. Each of the sisters intends to invest their $100,000 share of the distribution on January 1, 2019. They are considering the following two alternatives: Corporate Bonds Corporate bonds that provide a 6 percent coupon rate. These bonds can be purchased at their maturity value. They mature in 12 years. Common Stock The common shares are available at a price of $50 per share. These shares pay a well established annual eligible dividend of $3.25 per share. The income from these investments would not move any of the three sisters to a higher federal or provincial tax bracket. The provincial dividend tax credit on eligible dividends is equal to 25 percent of the dividend gross up. Each sister already has sufficient income to use all of her available tax credits. 345 Income From Property Assignment Problems Required: Advise each of the Brock sisters as to which investment they should make. As part of your recommendation, calculate the after tax return that would be generated for each of the sisters, assuming that they invested their $100,000 in: A. the corporate bonds. B. the common stock. Comment on any other factors that they should consider in making their choice. Assignment Problem Seven - 5 (Investments In Income Trusts And Common Stock) On January 1, 2019, Carolyn Jackson received a $200,000 inheritance from her mother. While she has no plans to use any of these funds during 2019, she and her three sisters plan to open a bed and breakfast in a year and she will need the funds to purchase her share of the business on January 1, 2020. In the meantime, she would like to invest the $200,000 for a one year period. She is consid- ering the following investments and would like your advice on the appropriate choice: Reel Estate Income Trust On January 1, 2019, this trust is selling for $25 per unit. It makes a distribution of $0.10 per unit per month. This distribution includes a return of capital of $0.01 per month, with the balance of the distribution being property income. Carolyn will sell the units at the end of 2019. She anticipates that these units will be selling for at least $26 per unit at that time. Ventex Inc. Common Stock On January 1, 2019, the shares of this public company are selling for $ 80 per share. The Company pays an annual eligible dividend of $3.00 per share. Carolyn anticipates that these shares will be selling for at least $85.00 per share on December 31, 2019. During 2019, Carolyn will continue to work at her present job. Her employment income is such that any additional income will be taxed at a combined federal/provincial rate of 32 percent. Carolyn lives in a province where the provincial dividend tax credit for eligible divi- dends is equal to 30 percent of the gross up. Required: Write a brief memorandum providing investment advice to Carolyn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts